Page 310 - DCOM205_ACCOUNTING_FOR_COMPANIES_II

P. 310

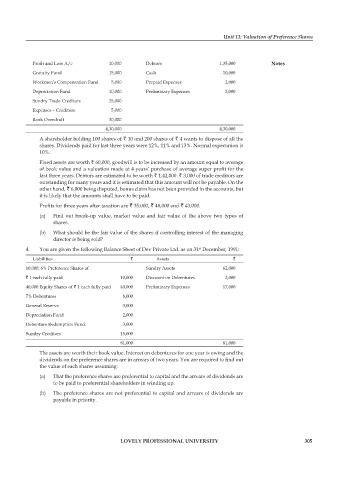

Unit 13: Valuation of Preference Shares

Profit and Loss A/c 10,000 Debtors 1,35,000 Notes

Gratuity Fund 15,000 Cash 10,000

Workmen’s Compensation Fund 5,000 Prepaid Expenses 2,000

Depreciation Fund 10,000 Preliminary Expenses 3,000

Sundry Trade Creditors 25,000

Expenses – Creditors 5,000

Bank Overdraft 30,000

4,30,000 4,30,000

A shareholder holding 100 shares of ` 10 and 200 shares of ` 4 wants to dispose of all the

shares. Dividends paid for last three years were 12%, 11% and 13%. Normal expectation is

10%.

Fixed assets are worth ` 60,000, goodwill is to be increased by an amount equal to average

of book value and a valuation made at 4 years’ purchase of average super profit for the

last three years. Debtors are estimated to be worth ` 1,42,000. ` 3,000 of trade creditors are

outstanding for many years and it is estimated that this amount will not be payable. On the

other hand, ` 6,000 being disputed, bonus claim has not been provided in the accounts, but

it is likely that the amounts shall have to be paid.

Profits for three years after taxation are ` 35,000, ` 48,000 and ` 43,000.

(a) Find out break-up value, market value and fair value of the above two types of

shares.

(b) What should be the fair value of the shares if controlling interest of the managing

director is being sold?

4. You are given the following Balance Sheet of Dev Private Ltd. as on 31 December, 1991:

st

Liabilities ` Assets `

10,000; 6% Preference Shares of Sundry Assets 62,000

` 1 each fully paid 10,000 Discount on Debentures 2,000

40,000 Equity Shares of ` 1 each fully paid 40,000 Preliminary Expenses 17,000

7% Debentures 8,000

General Reserve 3,000

Depreciation Fund 2,000

Debenture Redemption Fund. 3,000

Sundry Creditors 15,000

81,000 81,000

The assets are worth their book value. Interest on debentures for one year is owing and the

dividends on the preference shares are in arrears of two years. You are required to find out

the value of each shares assuming:

(a) That the preference shares are preferential to capital and the arrears of dividends are

to be paid to preferential shareholders in winding up.

(b) The preference shares are not preferential to capital and arrears of dividends are

payable in priority.

LOVELY PROFESSIONAL UNIVERSITY 305