Page 147 - DCOM206_COST_ACCOUNTING_II

P. 147

Cost Accounting – II

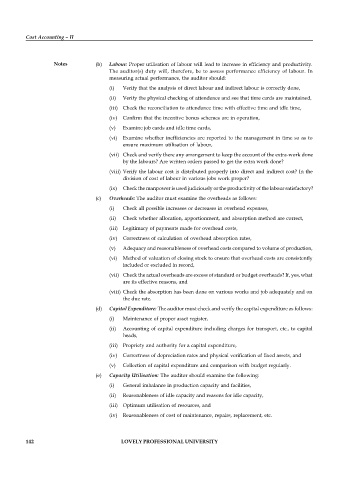

Notes (b) Labour: Proper utilisation of labour will lead to increase in efficiency and productivity.

The auditor(s) duty will, therefore, be to assess performance efficiency of labour. In

measuring actual performance, the auditor should:

(i) Verify that the analysis of direct labour and indirect labour is correctly done,

(ii) Verify the physical checking of attendance and see that time cards are maintained,

(iii) Check the reconciliation to attendance time with effective time and idle time,

(iv) Confirm that the incentive bonus schemes are in operation,

(v) Examine job cards and idle time cards,

(vi) Examine whether inefficiencies are reported to the management in time so as to

ensure maximum utilisation of labour,

(vii) Check and verify there any arrangement to keep the account of the extra-work done

by the labours? Are written orders passed to get the extra work done?

(viii) Verify the labour cost is distributed properly into direct and indirect cost? In the

division of cost of labour in various jobs work proper?

(ix) Check the manpower is used judiciously or the productivity of the labour satisfactory?

(c) Overheads: The auditor must examine the overheads as follows:

(i) Check all possible increases or decreases in overhead expenses,

(ii) Check whether allocation, apportionment, and absorption method are correct,

(iii) Legitimacy of payments made for overhead costs,

(iv) Correctness of calculation of overhead absorption rates,

(v) Adequacy and reasonableness of overhead costs compared to volume of production,

(vi) Method of valuation of closing stock to ensure that overhead costs are consistently

included or excluded in record,

(vii) Check the actual overheads are excess of standard or budget overheads? If, yes, what

are its effective reasons, and

(viii) Check the absorption has been done on various works and job adequately and on

the due rate.

(d) Capital Expenditure: The auditor must check and verify the capital expenditure as follows:

(i) Maintenance of proper asset register,

(ii) Accounting of capital expenditure including charges for transport, etc., to capital

heads,

(iii) Propriety and authority for a capital expenditure,

(iv) Correctness of depreciation rates and physical verification of fixed assets, and

(v) Collection of capital expenditure and comparison with budget regularly.

(e) Capacity Utilisation: The auditor should examine the following:

(i) General imbalance in production capacity and facilities,

(ii) Reasonableness of idle capacity and reasons for idle capacity,

(iii) Optimum utilisation of resources, and

(iv) Reasonableness of cost of maintenance, repairs, replacement, etc.

142 LOVELY PROFESSIONAL UNIVERSITY