Page 99 - DCOM208_BANKING_THEORY_AND_PRACTICE

P. 99

Banking Theory and Practice

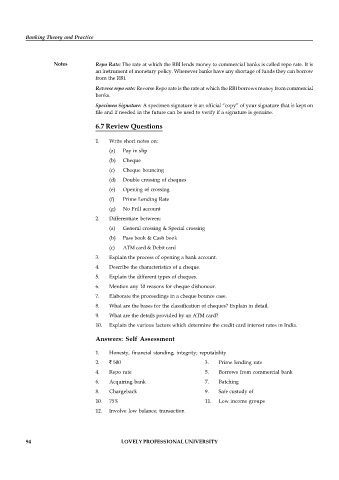

Notes Repo Rate: The rate at which the RBI lends money to commercial banks is called repo rate. It is

an instrument of monetary policy. Whenever banks have any shortage of funds they can borrow

from the RBI.

Reverse repo rate: Reverse Repo rate is the rate at which the RBI borrows money from commercial

banks.

Specimen Signature: A specimen signature is an official “copy” of your signature that is kept on

file and if needed in the future can be used to verify if a signature is genuine.

6.7 Review Questions

1. Write short notes on:

(a) Pay in slip

(b) Cheque

(c) Cheque bouncing

(d) Double crossing of cheques

(e) Opening of crossing

(f) Prime Lending Rate

(g) No Frill account

2. Differentiate between:

(a) General crossing & Special crossing

(b) Pass book & Cash book

(c) ATM card & Debit card

3. Explain the process of opening a bank account.

4. Describe the characteristics of a cheque.

5. Explain the different types of cheques.

6. Mention any 10 reasons for cheque dishonour.

7. Elaborate the proceedings in a cheque bounce case.

8. What are the bases for the classification of cheques? Explain in detail.

9. What are the details provided by an ATM card?

10. Explain the various factors which determine the credit card interest rates in India.

Answers: Self Assessment

1. Honesty, financial standing, integrity; reputability

2. ` 500 3. Prime lending rate

4. Repo rate 5. Borrows from commercial bank

6. Acquiring bank 7. Batching

8. Chargeback 9. Safe custody of

10. 75% 11. Low income groups

12. Involve low balance; transaction

94 LOVELY PROFESSIONAL UNIVERSITY