Page 208 - DCOM301_INCOME_TAX_LAWS_I

P. 208

Unit 7: Income under the Head Salaries

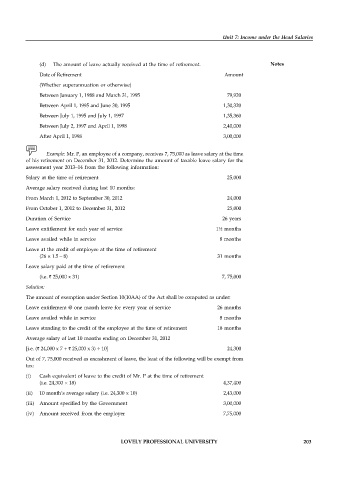

(d) The amount of leave actually received at the time of retirement. Notes

Date of Retirement Amount

(Whether superannuation or otherwise)

Between January 1, 1988 and March 31, 1995 79,920

Between April 1, 1995 and June 30, 1995 1,30,320

Between July 1, 1995 and July 1, 1997 1,35,360

Between July 2, 1997 and April 1, 1998 2,40,000

After April 1, 1998 3,00,000

Example: Mr. P, an employee of a company, receives 7, 75,000 as leave salary at the time

of his retirement on December 31, 2012. Determine the amount of taxable leave salary for the

assessment year 2013–14 from the following information:

Salary at the time of retirement 25,000

Average salary received during last 10 months:

From March 1, 2012 to September 30, 2012 24,000

From October 1, 2012 to December 31, 2012 25,000

Duration of Service 26 years

Leave entitlement for each year of service 1½ months

Leave availed while in service 8 months

Leave at the credit of employee at the time of retirement

(26 × 1.5 – 8) 31 months

Leave salary paid at the time of retirement

(i.e. ` 25,000 x 31) 7, 75,000

Solution:

The amount of exemption under Section 10(10AA) of the Act shall be computed as under:

Leave entitlement @ one month leave for every year of service 26 months

Leave availed while in service 8 months

Leave standing to the credit of the employee at the time of retirement 18 months

Average salary of last 10 months ending on December 31, 2012

[i.e. (` 24,000 x 7 + ` 25,000 x 3) ÷ 10] 24,300

Out of 7, 75,000 received as encashment of leave, the least of the following will be exempt from

tax:

(i) Cash equivalent of leave to the credit of Mr. P at the time of retirement

(i.e. 24,300 × 18) 4,37,400

(ii) 10 month’s average salary (i.e. 24,300 x 10) 2,43,000

(iii) Amount specified by the Government 3,00,000

(iv) Amount received from the employer 7,75,000

LOVELY PROFESSIONAL UNIVERSITY 203