Page 211 - DCOM301_INCOME_TAX_LAWS_I

P. 211

Income Tax Laws – I

Notes 11. Payment received out of an approved Superannuation Fund [Section 10(13)];

12. House rent allowance [Section 10(13A)];

13. Special allowances to meet the expenses of the duties [Section 10(14)];

14. Salary income of a member of Scheduled Tribe [Section 10(26)];

15. Salary income of a resident of Ladakh [Section 10(26A)].

Notes Tax Deducted at Source

Salaries payable by an employer are chargeable to tax in the hands of the employee and

are subject to deduction of tax at source under Section 192 of the Income-tax Act. The

obligation of the employer to deduct tax at source is mandatory and cannot be negotiated.

But in cases where there is any failure on the part of the employer to deduct the tax at

source, the employee cannot escape liability to tax; he would be chargeable to tax on his

entire income from salaries. The fact that the employer could be proceeded against and be

subjected to penalty or prosecution, would not absolve the employee of his liability to

pay tax on the income which should have been subjected to deduction of tax by the

employer. In every case, the tax deducted by the employer should be added to the employee’s

income and the gross amount should be taken as the taxable income of the employee.

Important examples of computation of Income from Salary are given below:

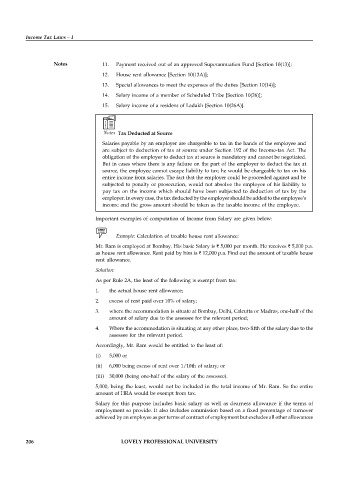

Example: Calculation of taxable house rent allowance:

Mr. Ram is employed at Bombay. His basic Salary is ` 5,000 per month. He receives ` 5,000 p.a.

as house rent allowance. Rent paid by him is ` 12,000 p.a. Find out the amount of taxable house

rent allowance.

Solution:

As per Rule 2A, the least of the following is exempt from tax:

1. the actual house rent allowance;

2. excess of rent paid over 10% of salary;

3. where the accommodation is situate at Bombay, Delhi, Calcutta or Madras, one-half of the

amount of salary due to the assessee for the relevant period;

4. Where the accommodation is situating at any other place, two-fifth of the salary due to the

assessee for the relevant period.

Accordingly, Mr. Ram would be entitled to the least of:

(i) 5,000 or

(ii) 6,000 being excess of rent over 1/10th of salary; or

(iii) 30,000 (being one-half of the salary of the assessee).

5,000, being the least, would not be included in the total income of Mr. Ram. So the entire

amount of HRA would be exempt from tax.

Salary for this purpose includes basic salary as well as dearness allowance if the terms of

employment so provide. It also includes commission based on a fixed percentage of turnover

achieved by an employee as per terms of contract of employment but excludes all other allowances

206 LOVELY PROFESSIONAL UNIVERSITY