Page 214 - DCOM301_INCOME_TAX_LAWS_I

P. 214

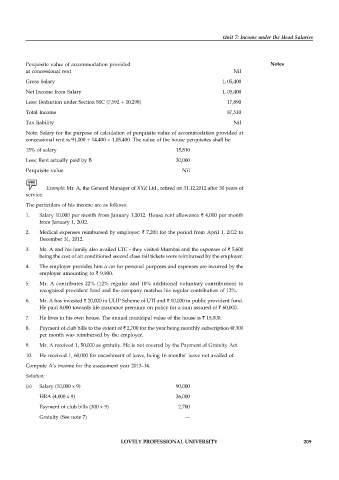

Unit 7: Income under the Head Salaries

Perquisite value of accommodation provided Notes

at concessional rent Nil

Gross Salary 1, 05,400

Net Income from Salary 1, 05,400

Less: Deduction under Section 80C (7,592 + 10,298) 17,890

Total Income 87,510

Tax liability Nil

Note: Salary for the purpose of calculation of perquisite value of accommodation provided at

concessional rent is 91,000 + 14,400 = 1,05,400. The value of the house perquisites shall be:

15% of salary 15,810

Less: Rent actually paid by B 30,000

Perquisite value Nil

Example: Mr. A, the General Manager of XYZ Ltd., retired on 31.12.2012 after 30 years of

service.

The particulars of his income are as follows:

1. Salary 10,000 per month from January 1,2012. House rent allowance ` 4,000 per month

from January 1, 2012.

2. Medical expenses reimbursed by employer: ` 7,200 for the period from April 1, 2012 to

December 31, 2012.

3. Mr. A and his family also availed LTC - they visited Mumbai and the expenses of ` 5,600

being the cost of air conditioned second class rail tickets were reimbursed by the employer.

4. The employer provides him a car for personal purposes and expenses are incurred by the

employer amounting to ` 9,900.

5. Mr. A contributes 22% (12% regular and 10% additional voluntary contribution) to

recognised provident fund and the company matches his regular contribution of 12%.

6. Mr. A has invested ` 20,000 in ULIP Scheme of UTI and ` 10,000 in public provident fund.

He paid 8,000 towards life insurance premium on policy for a sum assured of ` 60,000.

7. He lives in his own house. The annual municipal value of the house is ` 15,000.

8. Payment of club bills to the extent of ` 2,700 for the year being monthly subscription @ 300

per month was reimbursed by the employer.

9. Mr. A received 1, 50,000 as gratuity. He is not covered by the Payment of Gratuity Act.

10. He received 1, 60,000 for encashment of leave, being 16 months’ leave not availed of.

Compute A’s income for the assessment year 2013–14.

Solution:

(a) Salary (10,000 x 9) 90,000

HRA (4,000 x 9) 36,000

Payment of club bills (300 x 9) 2,700

Gratuity (See note 7) —

LOVELY PROFESSIONAL UNIVERSITY 209