Page 215 - DCOM301_INCOME_TAX_LAWS_I

P. 215

Income Tax Laws – I

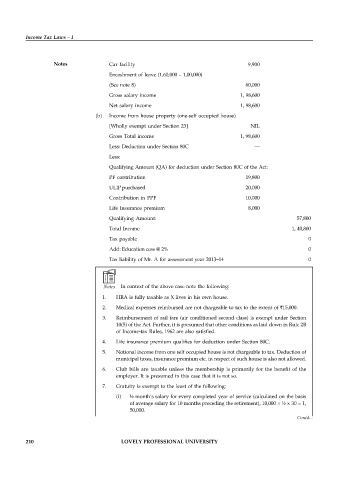

Notes Car facility 9,900

Encashment of leave (1,60,000 – 1,00,000)

(See note 8) 60,000

Gross salary income 1, 98,600

Net salary income 1, 98,600

(b) Income from house property (one-self occupied house)

[Wholly exempt under Section 23] NIL

Gross Total income 1, 98,600

Less: Deduction under Section 80C —

Less:

Qualifying Amount (QA) for deduction under Section 80C of the Act:

PF contribution 19,800

ULIP purchased 20,000

Contribution in PPF 10,000

Life Insurance premium 8,000

Qualifying Amount: 57,800

Total Income 1, 40,800

Tax payable 0

Add: Education cess @ 2% 0

Tax liability of Mr. A for assessment year 2013–14 0

Notes In context of the above case note the following:

1. HRA is fully taxable as X lives in his own house.

2. Medical expenses reimbursed are not chargeable to tax to the extent of `15,000.

3. Reimbursement of rail fare (air conditioned second class) is exempt under Section

10(5) of the Act. Further, it is presumed that other conditions as laid down in Rule 2B

of Income-tax Rules, 1962 are also satisfied.

4. Life insurance premium qualifies for deduction under Section 80C.

5. Notional income from one self occupied house is not chargeable to tax. Deduction of

municipal taxes, insurance premium etc. in respect of such house is also not allowed.

6. Club bills are taxable unless the membership is primarily for the benefit of the

employer. It is presumed in this case that it is not so.

7. Gratuity is exempt to the least of the following:

(i) ½ month’s salary for every completed year of service (calculated on the basis

of average salary for 10 months preceding the retirement), 10,000 × ½ × 30 = 1,

50,000.

Contd...

210 LOVELY PROFESSIONAL UNIVERSITY