Page 346 - DCOM301_INCOME_TAX_LAWS_I

P. 346

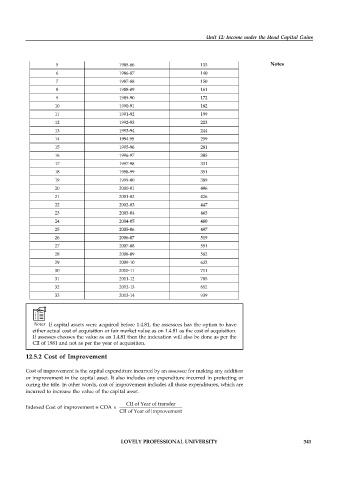

Unit 12: Income under the Head Capital Gains

5 1985-86 133 Notes

6 1986-87 140

7 1987-88 150

8 1988-89 161

9 1989-90 172

10 1990-91 182

11 1991-92 199

12 1992-93 223

13 1993-94 244

14 1994.95 259

15 1995-96 281

16 1996-97 305

17 1997-98 331

18 1998-99 351

19 1999-00 389

20 2000-01 406

21 2001-02 426

22 2002-03 447

23 2003-04 463

24 2004-05 480

25 2005-06 497

26 2006-07 519

27 2007-08 551

28 2008-09 582

29 2009-10 632

30 2010-11 711

31 2011-12 785

32 2012-13 852

33 2013-14 939

Notes If capital assets were acquired before 1.4.81, the assessees has the option to have

either actual cost of acquisition or fair market value as on 1.4.81 as the cost of acquisition.

If assesses chooses the value as on 1.4.81 then the indexation will also be done as per the

CII of 1981 and not as per the year of acquisition.

12.5.2 Cost of Improvement

Cost of improvement is the capital expenditure incurred by an assessee for making any addition

or improvement in the capital asset. It also includes any expenditure incurred in protecting or

curing the title. In other words, cost of improvement includes all those expenditures, which are

incurred to increase the value of the capital asset.

CII of Year of transfer

Indexed Cost of improvement = COA ×

CII of Year of improvement

LOVELY PROFESSIONAL UNIVERSITY 341