Page 347 - DCOM301_INCOME_TAX_LAWS_I

P. 347

Income Tax Laws – I

Notes Any cost of improvement incurred before 1 April 1981 is not considered or it is ignored. The

st

reason behind it is that for carrying any improvement in asset before 1 April 1981, asset should

st

st

st

have been purchased before 1 April 1981. If asset is purchased before 1 April we consider the

st

fair market value. The fair market value of asset on 1 April 1981 will certainly include the

improvement made in the asset.

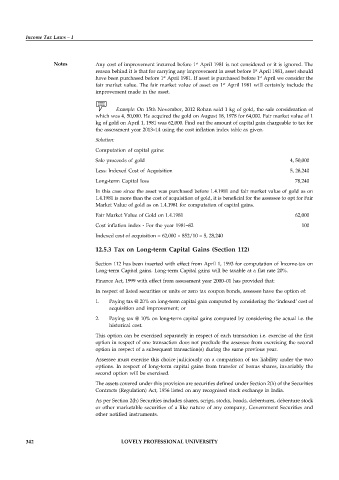

Example: On 15th November, 2012 Rohan sold 1 kg of gold, the sale consideration of

which was 4, 50,000. He acquired the gold on August 18, 1978 for 64,000. Fair market value of 1

kg of gold on April 1, 1981 was 62,000. Find out the amount of capital gain chargeable to tax for

the assessment year 2013–14 using the cost inflation index table as given.

Solution:

Computation of capital gains:

Sale proceeds of gold 4, 50,000

Less: Indexed Cost of Acquisition 5, 28,240

Long-term Capital loss 78,240

In this case since the asset was purchased before 1.4.1981 and fair market value of gold as on

1.4.1981 is more than the cost of acquisition of gold, it is beneficial for the assessee to opt for Fair

Market Value of gold as on 1.4.1981 for computation of capital gains.

Fair Market Value of Gold on 1.4.1981 62,000

Cost inflation index - For the year 1981–82 100

Indexed cost of acquisition = 62,000 × 852/10 = 5, 28,240

12.5.3 Tax on Long-term Capital Gains (Section 112)

Section 112 has been inserted with effect from April 1, 1993 for computation of Income-tax on

Long-term Capital gains. Long-term Capital gains will be taxable at a flat rate 20%.

Finance Act, 1999 with effect from assessment year 2000–01 has provided that:

In respect of listed securities or units or zero tax coupon bonds, assessee have the option of:

1. Paying tax @ 20% on long-term capital gain computed by considering the ‘indexed’ cost of

acquisition and improvement; or

2. Paying tax @ 10% on long-term capital gains computed by considering the actual i.e. the

historical cost.

This option can be exercised separately in respect of each transaction i.e. exercise of the first

option in respect of one transaction does not preclude the assessee from exercising the second

option in respect of a subsequent transaction(s) during the same previous year.

Assessee must exercise this choice judiciously on a comparison of tax liability under the two

options. In respect of long-term capital gains from transfer of bonus shares, invariably the

second option will be exercised.

The assets covered under this provision are securities defined under Section 2(h) of the Securities

Contracts (Regulation) Act, 1956 listed on any recognised stock exchange in India.

As per Section 2(h) Securities includes shares, scrips, stocks, bonds, debentures, debenture stock

or other marketable securities of a like nature of any company, Government Securities and

other notified instruments.

342 LOVELY PROFESSIONAL UNIVERSITY