Page 351 - DCOM301_INCOME_TAX_LAWS_I

P. 351

Income Tax Laws – I

Notes

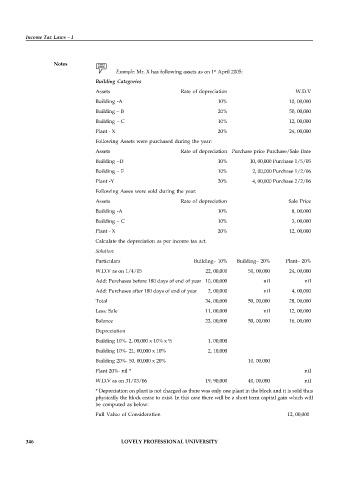

Example: Mr. X has following assets as on 1 April 2005:

st

Building Categories

Assets Rate of depreciation W.D.V

Building -A 10% 10, 00,000

Building – B 20% 50, 00,000

Building – C 10% 12, 00,000

Plant - X 20% 24, 00,000

Following Assets were purchased during the year:

Assets Rate of depreciation Purchase price Purchase/Sale Date

Building –D 10% 10, 00,000 Purchase 1/5/05

Building – F 10% 2, 00,000 Purchase 1/2/06

Plant -Y 20% 4, 00,000 Purchase 2/2/06

Following Asses were sold during the year:

Assets Rate of depreciation Sale Price

Building -A 10% 8, 00,000

Building – C 10% 3, 00,000

Plant - X 20% 12, 00,000

Calculate the depreciation as per income tax act.

Solution:

Particulars Building– 10% Building– 20% Plant– 20%

W.D.V as on 1/4/05 22, 00,000 50, 00,000 24, 00,000

Add: Purchases before 180 days of end of year 10, 00,000 nil nil

Add: Purchases after 180 days of end of year 2, 00,000 nil 4, 00,000

Total 34, 00,000 50, 00,000 28, 00,000

Less: Sale 11, 00,000 nil 12, 00,000

Balance 23, 00,000 50, 00,000 16, 00,000

Depreciation

Building 10%- 2, 00,000 x 10% x ½ 1, 00,000

Building 10%- 21, 00,000 x 10% 2, 10,000

Building 20%- 50, 00,000 x 20% 10, 00,000

Plant 20%- nil * nil

W.D.V as on 31/03/06 19, 90,000 40, 00,000 nil

* Depreciation on plant is not charged as there was only one plant in the block and it is sold thus

physically the block cease to exist. In this case there will be a short term capital gain which will

be computed as below:

Full Value of Consideration 12, 00,000

346 LOVELY PROFESSIONAL UNIVERSITY