Page 353 - DCOM301_INCOME_TAX_LAWS_I

P. 353

Income Tax Laws – I

Notes (c) Where the Assessing Officer is of the opinion that, having regard to the nature of an asset

and relevant circumstances, it is necessary so to make a reference to the Valuation Officer

[Section 55A(b)(ii)].

It may be noted that in a case where the assessee has opted for substitution of the cost of

acquisition of an asset by its fair market value as on 1.4.1981, the fair market value as claimed by

him may be higher than its actual fair market value. The provisions of Section 55A(a) and (b)(i)

are, therefore, not applicable to such a case. It is, however, open to the Assessing Officer to make

a reference to the Valuation Officer under Section 55A(b)(ii). The Central Government has

appointed a large number of Valuation Officers under Section 12A of the Wealth-tax Act and

these Valuation Officers exercise their functions in relation to the categories of asset for which

they have been appointed. The jurisdiction of the Valuation Officers has been defined in Rule 3A

of the Wealth-tax Rules. The Valuation Officer exercises the same jurisdiction for income tax

purposes also.

!

Caution Note that in cases covered by Section 55A (a) and (b)(i) above it is the duty of the

Assessing Officer to refer the valuation of the capital asset in question to the Valuation

Officer attached to the department and not to decide the question of the valuation on his

own.

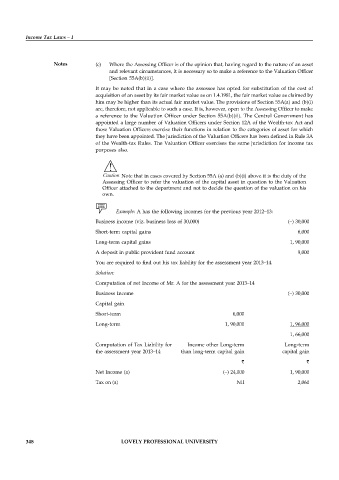

Example: A has the following incomes for the previous year 2012–13:

Business income (viz. business loss of 30,000) (–) 30,000

Short-term capital gains 6,000

Long-term capital gains 1, 90,000

A deposit in public provident fund account 9,000

You are required to find out his tax liability for the assessment year 2013–14.

Solution:

Computation of net Income of Mr. A for the assessment year 2013–14

Business Income (–) 30,000

Capital gain

Short-term 6,000

Long-term 1, 90,000 1, 96,000

1, 66,000

Computation of Tax Liability for Income other Long-term Long-term

the assessment year 2013–14 than long-term capital gain capital gain

` `

Net Income (a) (–) 24,000 1, 90,000

Tax on (a) Nil 2,060

348 LOVELY PROFESSIONAL UNIVERSITY