Page 381 - DCOM301_INCOME_TAX_LAWS_I

P. 381

Income Tax Laws – I

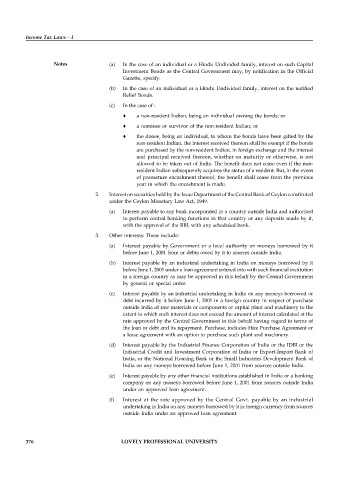

Notes (a) In the case of an individual or a Hindu Undivided family, interest on such Capital

Investment Bonds as the Central Government may, by notification in the Official

Gazette, specify.

(b) In the case of an individual or a Hindu Undivided family, interest on the notified

Relief Bonds.

(c) In the case of :

a non-resident Indian, being an individual owning the bonds; or

a nominee or survivor of the non-resident Indian; or

the donee, being an individual, to whom the bonds have been gifted by the

non-resident Indian, the interest received thereon shall be exempt if the bonds

are purchased by the non-resident Indian, in foreign exchange and the interest

and principal received thereon, whether on maturity or otherwise, is not

allowed to be taken out of India. The benefit does not cease even if the non-

resident Indian subsequently acquires the status of a resident. But, in the event

of premature encashment thereof, the benefit shall cease from the previous

year in which the encashment is made.

2. Interest on securities held by the Issue Department of the Central Bank of Ceylon constituted

under the Ceylon Monetary Law Act, 1949.

(a) Interest payable to any bank incorporated in a country outside India and authorised

to perform central banking functions in that country or any deposits made by it,

with the approval of the RBI, with any scheduled bank.

3. Other interests: These include:

(a) Interest payable by Government or a local authority on moneys borrowed by it

before June 1, 2001 from or debts owed by it to sources outside India.

(b) Interest payable by an industrial undertaking in India on moneys borrowed by it

before June 1, 2001 under a loan agreement entered into with such financial institution

in a foreign country as may be approved in this behalf by the Central Government

by general or special order.

(c) Interest payable by an industrial undertaking in India on any moneys borrowed or

debt incurred by it before June 1, 2001 in a foreign country in respect of purchase

outside India of raw materials or components or capital plant and machinery to the

extent to which such interest does not exceed the amount of interest calculated at the

rate approved by the Central Government in this behalf having regard to terms of

the loan or debt and its repayment. Purchase, includes Hire Purchase Agreement or

a lease agreement with an option to purchase such plant and machinery.

(d) Interest payable by the Industrial Finance Corporation of India or the IDBI or the

Industrial Credit and Investment Corporation of India or Export-Import Bank of

India, or the National Housing Bank or the Small Industries Development Bank of

India on any moneys borrowed before June 1, 2001 from sources outside India.

(e) Interest payable by any other financial institutions established in India or a banking

company on any moneys borrowed before June 1, 2001 from sources outside India

under an approved loan agreement.

(f) Interest at the rate approved by the Central Govt. payable by an industrial

undertaking in India on any moneys borrowed by it in foreign currency from sources

outside India under an approved loan agreement.

376 LOVELY PROFESSIONAL UNIVERSITY