Page 384 - DCOM301_INCOME_TAX_LAWS_I

P. 384

Unit 13: Income from Other Sources

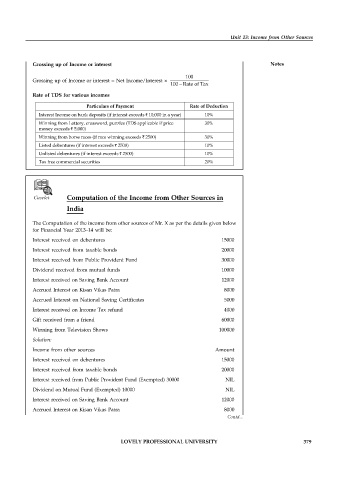

Grossing up of Income or interest Notes

100

Grossing up of Income or interest = Net Income/Interest ×

100 Rate of Tax

−

Rate of TDS for various incomes

Particulars of Payment Rate of Deduction

Interest Income on bank deposits (if interest exceeds ` 10,000 in a year) 10%

Winning from Lottery, crossword, puzzles (TDS applicable if price 30%

money exceeds ` 5,000)

Winning from horse races (if race winning exceeds ` 2500) 30%

Listed debentures (if interest exceeds ` 2500) 10%

Unlisted debentures (if interest exceeds ` 2500) 10%

Tax free commercial securities 20%

Caselet Computation of the Income from Other Sources in

India

The Computation of the income from other sources of Mr. X as per the details given below

for Financial Year 2013–14 will be:

Interest received on debentures 15000

Interest received from taxable bonds 20000

Interest received from Public Provident Fund 30000

Dividend received from mutual funds 10000

Interest received on Saving Bank Account 12000

Accrued Interest on Kisan Vikas Patra 8000

Accrued Interest on National Saving Certificates 5000

Interest received on Income Tax refund 4000

Gift received from a friend 60000

Winning from Television Shows 100000

Solution:

Income from other sources Amount

Interest received on debentures 15000

Interest received from taxable bonds 20000

Interest received from Public Provident Fund (Exempted) 30000 NIL

Dividend on Mutual Fund (Exempted) 10000 NIL

Interest received on Saving Bank Account 12000

Accrued Interest on Kisan Vikas Patra 8000

Contd...

LOVELY PROFESSIONAL UNIVERSITY 379