Page 127 - DCOM302_MANAGEMENT_ACCOUNTING

P. 127

Management Accounting

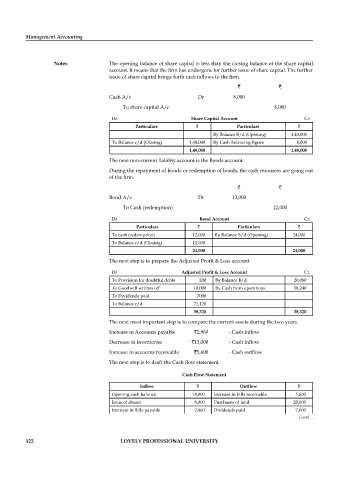

Notes The opening balance of share capital is less than the closing balance of the share capital

account. It means that the firm has undergone for further issue of share capital. The further

issue of share capital brings forth cash inflows to the fi rm.

` `

Cash A/c Dr 8,000

To share capital A/c 8,000

Dr. Share Capital Account Cr.

Particulars ` Particulars `

By Balance B/d (Opening) 1,40,000

To Balance c/d (Closing) 1,48,000 By Cash Balancing fi gure 8,000

1,48,000 1,48,000

The next non-current liability account is the Bonds account.

During the repayment of bonds or redemption of bonds, the cash resources are going out

of the fi rm.

` `

Bond A/c Dr 12,000

To Cash (redemption) 12,000

Dr. Bond Account Cr.

Particulars ` Particulars `

To cash (redemption) 12,000 By Balance B/d (Opening) 24,000

To Balance c/d (Closing) 12,000

24,000 24,000

The next step is to prepare the Adjusted Profit & Loss account

Dr. Adjusted Profit & Loss Account Cr.

To Provision for doubtful debts 200 By Balance B/d 20,080

To Goodwill written off 10,000 By Cash from operations 18,240

To Dividends paid 7000

To Balance c/d 21,120

38,320 38,320

The next most important step is to compare the current assets during the two years.

Increase in Accounts payable `2,960 - Cash infl ow

Decrease in Inventories `13,000 - Cash infl ow

Increase in accounts receivable `5,600 - Cash outfl ow

The next step is to draft the Cash fl ow statement.

Cash Flow Statement

Infl ow ` Outfl ow `

Opening cash balance 18,000 Increase in bills receivable 5,600

Issue of shares 8,000 Purchases of land 20,000

Increase in Bills payable 2,960 Dividends paid 7,000

Contd…

122 LOVELY PROFESSIONAL UNIVERSITY