Page 125 - DCOM302_MANAGEMENT_ACCOUNTING

P. 125

Management Accounting

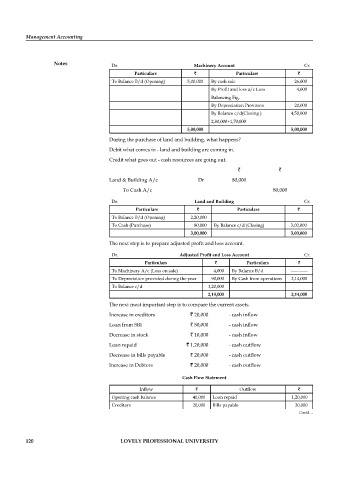

Notes Dr. Machinery Account Cr.

Particulars ` Particulars `

To Balance B/d (Opening) 5,00,000 By cash sale 26,000

By Profit and loss a/c Loss 4,000

Balancing Fig.

By Depreciation Provision 20,000

By Balance c/d(Closing ) 4,50,000

2,80,000+1,70,000

5,00,000 5,00,000

During the purchase of land and building, what happens?

Debit what comes in - land and building are coming in.

Credit what goes out - cash resources are going out.

` `

Land & Building A/c Dr 80,000

To Cash A/c 80,000

Dr. Land and Building Cr.

Particulars ` Particulars `

To Balance B/d (Opening) 2,20,000

To Cash (Purchase) 80,000 By Balance c/d (Closing) 3,00,000

3,00,000 3,00,000

The next step is to prepare adjusted profit and loss account.

Dr. Adjusted Profit and Loss Account Cr.

Particulars ` Particulars `

To Machinery A/c (Loss on sale) 4,000 By Balance B/d -----------

To Depreciation provided during the year 90,000 By Cash from operations 2,14,000

To Balance c/d 1,20,000

2,14,000 2,14,000

The next most important step is to compare the current assets.

Increase in creditors ` 20,000 - cash infl ow

Loan from SBI ` 50,000 - cash infl ow

Decrease in stock ` 10,000 - cash infl ow

Loan repaid ` 1,20,000 - cash outfl ow

Decrease in bills payable ` 20,000 - cash outfl ow

Increase in Debtors ` 20,000 - cash outfl ow

Cash Flow Statement

Infl ow ` Outfl ow `

Opening cash balance 40,000 Loan repaid 1,20,000

Creditors 20,000 Bills payable 20,000

Contd…

120 LOVELY PROFESSIONAL UNIVERSITY