Page 120 - DCOM302_MANAGEMENT_ACCOUNTING

P. 120

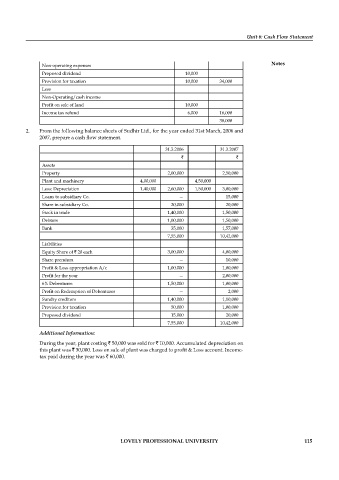

Unit 6: Cash Flow Statement

Non-operating expenses Notes

Proposed dividend 10,000

Provision for taxation 10,000 34,000

Less

Non-Operating/cash income

Profit on sale of land 10,000

Income tax refund 6,000 16,000

38,000

2. From the following balance sheets of Sudhir Ltd., for the year ended 31st March, 2006 and

2007, prepare a cash fl ow statement.

31.3.2006 31.3.2007

` `

Assets

Property 2,00,000 2,50,000

Plant and machinery 4,00,000 4,50,000

Less: Depreciation 1,40,000 2,60,000 1,50,000 3,00,000

Loans to subsidiary Co. — 15,000

Share in subsidiary Co. 20,000 20,000

Stock in trade 1,40,000 1,50,000

Debtors 1,00,000 1,50,000

Bank 35,000 1,57,000

7,55,000 10,42,000

Liabilities

Equity Share of ` 20 each 3,00,000 4,00,000

Share premium — 10,000

Profit & Loss appropriation A/c 1,00,000 1,00,000

Profit for the year — 2,00,000

6% Debentures 1,50,000 1,00,000

Profit on Redemption of Debentures — 2,000

Sundry creditors 1,40,000 1,10,000

Provision for taxation 50,000 1,00,000

Proposed dividend 15,000 20,000

7,55,000 10,42,000

Additional Information:

During the year, plant costing ` 50,000 was sold for ` 10,000. Accumulated depreciation on

this plant was ` 30,000. Loss on sale of plant was charged to profit & Loss account. Income-

tax paid during the year was ` 60,000.

LOVELY PROFESSIONAL UNIVERSITY 115