Page 271 - DCOM302_MANAGEMENT_ACCOUNTING

P. 271

Management Accounting

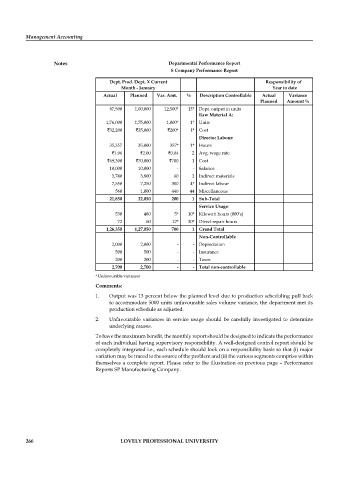

Notes Departmental Performance Report

S Company Performance Report

Dept. Prod. Dept. X Current Responsibility of

Month - January Year to date

Actual Planned Var. Amt. % Description Controllable Actual Variance

Planned Amount %

87,500 1,00,000 12,500* 13* Dept. output in units

Raw Material A:

1,76,000 1,75,000 1,000* 1* Units

`32,200 `35,000 `200* 1* Cost

Director Labour:

35,357 35,000 357* 1* Hours

`1.96 `2.00 `0.04 2 Avg. wage rate

`69,300 `70,000 `700 1 Cost

10,000 10,000 - - Salaries

3,740 3,800 60 2 Indirect materials

7,550 7,250 300 4* Indirect labour

560 1,000 440 44 Miscellaneous

21,850 22,050 200 1 Sub-Total

Service Usage:

530 480 5* 10* Kilowatt hours (000’s)

72 60 12* 20* Direct repair hours

1,26,350 1,27,050 700 1 Grand Total

Non-Controllable

2,000 2,000 - - Depreciation

500 500 - - Insurance

200 200 . . Taxes

2,700 2,700 - - Total non-controllable

* Unfavourable variances

Comments:

1. Output was 13 percent below the planned level due to production scheduling pull back

to accommodate 5000 units unfavourable sales volume variance, the department met its

production schedule as adjusted.

2. Unfavourable variances in service usage should be carefully investigated to determine

underlying causes.

To have the maximum benefit, the monthly report should be designed to indicate the performance

of each individual having supervisory responsibility. A well-designed control report should be

completely integrated i.e., each schedule should look on a responsibility basis so that (i) major

variation may be traced to the source of the problem and (ii) the various segments comprise within

themselves a complete report. Please refer to the illustration on previous page – Performance

Reports SP Manufacturing Company.

266 LOVELY PROFESSIONAL UNIVERSITY