Page 137 - DMGT405_FINANCIAL%20MANAGEMENT

P. 137

Unit 7: Capital Structure Decision

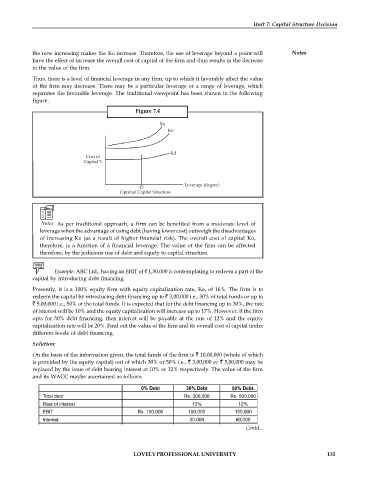

the now increasing makes the Ko increase. Therefore, the use of leverage beyond a point will Notes

have the effect of increase the overall cost of capital of the firm and thus results in the decrease

in the value of the firm.

Thus, there is a level of financial leverage in any firm, up to which it favorably affect the value

of the firm may decrease. There may be a particular leverage or a range of leverage, which

separates the favorable leverage. The traditional viewpoint has been shown in the following

figure.

Figure 7.4

Notes As per traditional approach, a firm can be benefited from a moderate level of

leverage when the advantage of using debt (having lower cost) outweigh the disadvantages

of increasing Ke (as a result of higher financial risk). The overall cost of capital Ko,

therefore, is a function of a financial leverage. The value of the firm can be affected

therefore, by the judicious use of debt and equity to capital structure.

Example: ABC Ltd., having an EBIT of 1,50,000 is contemplating to redeem a part of the

capital by introducing debt financing.

Presently, it is a 100% equity firm with equity capitalization rate, Ke, of 16%. The firm is to

redeem the capital by introducing debt financing up to 3,00,000 i.e., 30% of total funds or up to

5,00,000 i.e., 50% of the total funds. It is expected that for the debt financing up to 30%, the rate

of interest will be 10% and the equity capitalization will increase up to 17%. However, if the firm

opts for 50% debt financing, then interest will be payable at the rate of 12% and the equity

capitalization rate will be 20%. Find out the value of the firm and its overall cost of capital under

different levels of debt financing.

Solution:

On the basis of the information given, the total funds of the firm is 10,00,000 (whole of which

is provided by the equity capital) out of which 30% or 50% i.e., 3,00,000 or 5,00,000 may be

replaced by the issue of debt bearing interest at 10% or 12% respectively. The value of the firm

and its WACC maybe ascertained as follows:

Contd...

LOVELY PROFESSIONAL UNIVERSITY 131