Page 138 - DMGT405_FINANCIAL%20MANAGEMENT

P. 138

Financial Management

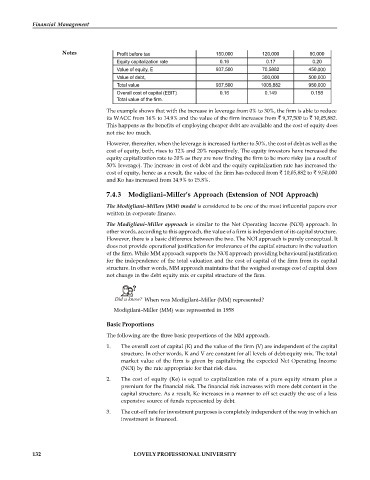

Notes

The example shows that with the increase in leverage from 0% to 30%, the firm is able to reduce

its WACC from 16% to 14.9% and the value of the firm increases from 9,37,500 to 10,05,882.

This happens as the benefits of employing cheaper debt are available and the cost of equity does

not rise too much.

However, thereafter, when the leverage is increased further to 50%, the cost of debt as well as the

cost of equity, both, rises to 12% and 20% respectively. The equity investors have increased the

equity capitalization rate to 20% as they are now finding the firm to be more risky (as a result of

50% leverage). The increase in cost of debt and the equity capitalization rate has increased the

cost of equity, hence as a result, the value of the firm has reduced from 10,05,882 to 9,50,000

and Ko has increased from 14.9% to 15.8%.

7.4.3 Modigliani–Miller’s Approach (Extension of NOI Approach)

The Modigliani–Millers (MM) model is considered to be one of the most influential papers ever

written in corporate finance.

The Modigliani–Miller approach is similar to the Net Operating Income (NOI) approach. In

other words, according to this approach, the value of a firm is independent of its capital structure.

However, there is a basic difference between the two. The NOI approach is purely conceptual. It

does not provide operational justification for irrelevance of the capital structure in the valuation

of the firm. While MM approach supports the NOI approach providing behavioural justification

for the independence of the total valuation and the cost of capital of the firm from its capital

structure. In other words, MM approach maintains that the weighed average cost of capital does

not change in the debt equity mix or capital structure of the firm.

Did u know? When was Modigilani–Miller (MM) represented?

Modigilani–Miller (MM) was represented in 1958

Basic Proportions

The following are the three basic proportions of the MM approach.

1. The overall cost of capital (K) and the value of the firm (V) are independent of the capital

structure. In other words, K and V are constant for all levels of debt-equity mix. The total

market value of the firm is given by capitalizing the expected Net Operating Income

(NOI) by the rate appropriate for that risk class.

2. The cost of equity (Ke) is equal to capitalization rate of a pure equity stream plus a

premium for the financial risk. The financial risk increases with more debt content in the

capital structure. As a result, Ke increases in a manner to off set exactly the use of a less

expensive source of funds represented by debt.

3. The cut-off rate for investment purposes is completely independent of the way in which an

investment is financed.

132 LOVELY PROFESSIONAL UNIVERSITY