Page 182 - DMGT405_FINANCIAL%20MANAGEMENT

P. 182

Financial Management

Notes Decision: If the capital is adequate there are no constraints, the proposal that gives higher NPV

should be selected. In this case, the Deluxe Model.

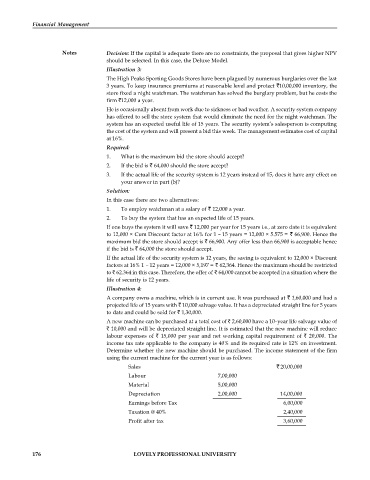

Illustration 3:

The High Peaks Sporting Goods Stores have been plagued by numerous burglaries over the last

3 years. To keep insurance premiums at reasonable level and protect 10,00,000 inventory, the

store fixed a night watchman. The watchman has solved the burglary problem, but he costs the

firm 12,000 a year.

He is occasionally absent from work due to sickness or bad weather. A security system company

has offered to sell the store system that would eliminate the need for the night watchman. The

system has an expected useful life of 15 years. The security system’s salesperson is computing

the cost of the system and will present a bid this week. The management estimates cost of capital

at 16%.

Required:

1. What is the maximum bid the store should accept?

2. If the bid is 64,000 should the store accept?

3. If the actual life of the security system is 12 years instead of 15, does it have any effect on

your answer in part (b)?

Solution:

In this case there are two alternatives:

1. To employ watchman at a salary of 12,000 a year.

2. To buy the system that has an expected life of 15 years.

If one buys the system it will save 12,000 per year for 15 years i.e., at zero date it is equivalent

to 12,000 × Cum Discount factor at 16% for 1 – 15 years = 12,000 × 5.575 = 66,900. Hence the

maximum bid the store should accept is 66,900. Any offer less than 66,900 is acceptable hence

if the bid is 64,000 the store should accept.

If the actual life of the security system is 12 years, the saving is equivalent to 12,000 × Discount

factors at 16% 1 – 12 years = 12,000 × 5,197 = 62,364. Hence the maximum should be restricted

to 62.364 in this case. Therefore, the offer of 64,000 cannot be accepted in a situation where the

life of security is 12 years.

Illustration 4:

A company owns a machine, which is in current use. It was purchased at 1,60,000 and had a

projected life of 15 years with 10,000 salvage value. It has a depreciated straight line for 5 years

to date and could be sold for 1,30,000.

A new machine can be purchased at a total cost of 2,60,000 have a 10–year life salvage value of

10,000 and will be depreciated straight line. It is estimated that the new machine will reduce

labour expenses of 15,000 per year and net working capital requirement of 20,000. The

income tax rate applicable to the company is 40% and its required rate is 12% on investment.

Determine whether the new machine should be purchased. The income statement of the firm

using the current machine for the current year is as follows:

Sales 20,00,000

Labour 7,00,000

Material 5,00,000

Depreciation 2,00,000 14,00,000

Earnings before Tax 6,00,000

Taxation @ 40% 2,40,000

Profit after tax 3,60,000

176 LOVELY PROFESSIONAL UNIVERSITY