Page 121 - DMGT405_FINANCIAL%20MANAGEMENT

P. 121

(in millions excepts per

2005

2002

2003

2001

2004

2000

2006

share data)

Revenues

Cost of goods sold

5,503.0 6,065.5 5,493.5 5,403.8 7,784.9

2,865.3 3,906.7

Gross profit

1,895.6 2,563.9

3,683.5 3,487.6 3,283.4 3,591.3 3,703.9

2,303.7 2,623.8 2,426.6 2,606.4 2,689.7

Selling and administrative

1,209.8 1,588.6

863.8

Operating Income

984.9 1,014.2

685.8

1,379.8

856.8

975.3

52.3

Interst expense

45.0

24.2

58.7

39.5

60.0

44.1

23.2

21.5

11.7

34.1

20.9

Other expense net

32.3

36.7

---

Restructuring charge,net

129.9

45.1

---

2.5

---

---

899.1 1,295.20

921.4

746.1

653.0

Income before Income taxes

919.2

649.9

253.4

340.1

294.7

345.9

499.4

Income taxes 4,760.8 6,470.6 9,816.5 9,553.1 8,776.9 8,995.1 9,488.8

250.2

331.7

Net Income 399.7 553.2 795.8 399.6 451.4 579.4 589.7

Diluted earning per Annum Unit 6: Cost of Capital

Shares 1.4 1.9 2.7 1.4 1.6 2.1 2.2

Average shares outstanding

(diluted) 294.0 293.6 297.0 296.0 287.5 279.8 273.3

Notes

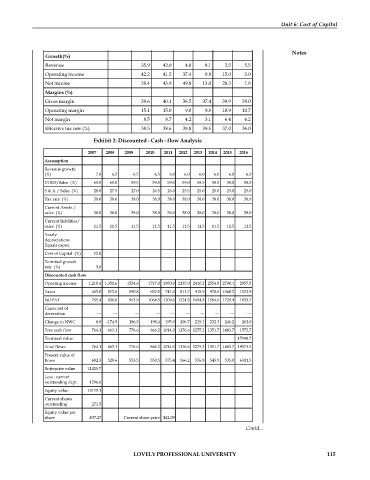

Growth(%)

Revenue 35.9 42.0 4.0 8.1 2.5 5.5

Operating income 42.2 41.5 37.4 0.8 15.0 3.0

Net income 38.4 43.9 49.8 13.0 28.3 1.8

Margins (%)

Gross margin 39.6 40.1 36.5 37.4 39.9 39.0

Operating margin 15.1 15.0 9.0 9.8 10.9 10.7

Net margin 8.5 8.7 4.2 3.1 6.4 6.2

Effective tax rate (%) 38.5 38.6 38.8 39.5 37.0 36.0

Exhibit 2: Discounted - Cash - flow Analysis

2007 2008 2009 2010 2011 2012 2013 2014 2015 2016

Assumption

Revenue growth

(%) 7.0 6.5 6.5 6.5 6.0 6.0 6.0 6.0 6.0 6.0

COGS/Sales (%) 60.0 60.0 59.5 59.5 59.0 59.0 58.5 58.5 58.0 58.0

S & A / Sales (%) 28.0 27.5 27.0 26.5 26.0 25.5 25.0 25.0 25.0 25.0

Tax rate (%) 38.0 38.0 38.0 38.0 38.0 38.0 38.0 38.0 38.0 38.0

Current Assets /

sales (%) 38.0 38.0 38.0 38.0 38.0 38.0 38.0 38.0 38.0 38.0

Current liabilities/

sales (%) 11.5 11.5 11.5 11.5 11.5 11.5 11.5 11.5 11.5 11.5

Yearly

depreciations

Equals capex.

Cost of Capital (%) 12.0

Terminal growth

rate (%) 3.0

Discounted cash flow

Opeating income 1,218.4 1,351.6 1554.6 1717.0 1950.0 2135.9 2410.2 2554.8 2790.1 2957.5

Taxes 463.0 513.6 590.8 652.5 741.0 811.7 915.9 970.8 1060.2 1123.9

NOPAT 755.4 838.0 963.9 1064.5 1209.0 1324.3 1494.3 1584.0 1729.9 1833.7

Capex.net of

dereciation --- --- --- --- --- --- --- --- --- ---

Change in NWC 8.8 -174.9 186.3 198.4 195.0 206.7 219.1 232.3 246.2 261.0

Free cash flow 764.1 663.1 776.6 866.2 1014.0 1176.6 1275.2 1351.7 1483.7 1572.7

Terminal value 17998.7

Total flows 764.1 663.1 776.6 866.2 1014.0 1176.6 1275.2 1351.7 1483.7 19571.5

Present value of

flows 682.3 528.6 553.5 550.5 575.4 566.2 576.8 545.9 535.0 6301.5

Enterprise value 11415.7

Less : current

outstanding dept. 1296.6

Equity value 10119.1

Current shares

outstanding 271.5

Equity value per

share $37.27 Current share price $42.09

Contd...

LOVELY PROFESSIONAL UNIVERSITY 115