Page 265 - DMGT405_FINANCIAL%20MANAGEMENT

P. 265

Unit 12: Receivables Management

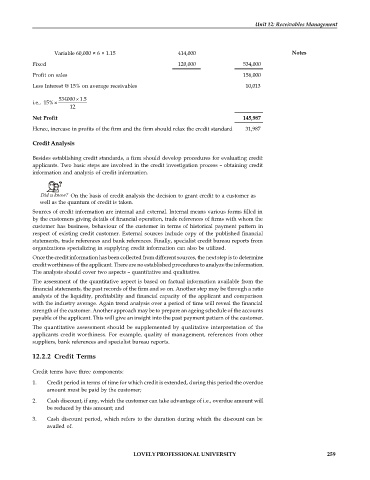

Variable 60,000 × 6 × 1.15 414,000 Notes

Fixed 120,000 534,000

Profit on sales 156,000

Less Interest @ 15% on average receivables 10,013

534000 ´ 1.5

i.e., 15% ´

12

Net Profit 145,987

Hence, increase in profits of the firm and the firm should relax the credit standard 31,987

Credit Analysis

Besides establishing credit standards, a firm should develop procedures for evaluating credit

applicants. Two basic steps are involved in the credit investigation process – obtaining credit

information and analysis of credit information.

Did u know? On the basis of credit analysis the decision to grant credit to a customer as

well as the quantum of credit is taken.

Sources of credit information are internal and external. Internal means various forms filled in

by the customers giving details of financial operation, trade references of firms with whom the

customer has business, behaviour of the customer in terms of historical payment pattern in

respect of existing credit customer. External sources include copy of the published financial

statements, trade references and bank references. Finally, specialist credit bureau reports from

organizations specializing in supplying credit information can also be utilized.

Once the credit information has been collected from different sources, the next step is to determine

credit worthiness of the applicant. There are no established procedures to analyze the information.

The analysis should cover two aspects – quantitative and qualitative.

The assessment of the quantitative aspect is based on factual information available from the

financial statements, the past records of the firm and so on. Another step may be through a ratio

analysis of the liquidity, profitability and financial capacity of the applicant and comparison

with the industry average. Again trend analysis over a period of time will reveal the financial

strength of the customer. Another approach may be to prepare an ageing schedule of the accounts

payable of the applicant. This will give an insight into the past payment pattern of the customer.

The quantitative assessment should be supplemented by qualitative interpretation of the

applicants credit worthiness. For example, quality of management, references from other

suppliers, bank references and specialist bureau reports.

12.2.2 Credit Terms

Credit terms have three components:

1. Credit period in terms of time for which credit is extended, during this period the overdue

amount must be paid by the customer;

2. Cash discount, if any, which the customer can take advantage of i.e., overdue amount will

be reduced by this amount; and

3. Cash discount period, which refers to the duration during which the discount can be

availed of.

LOVELY PROFESSIONAL UNIVERSITY 259