Page 180 - DCOM504_SECURITY_ANALYSIS_AND_PORTFOLIO_MANAGEMENT

P. 180

Unit 6: Technical Analysis

Notes

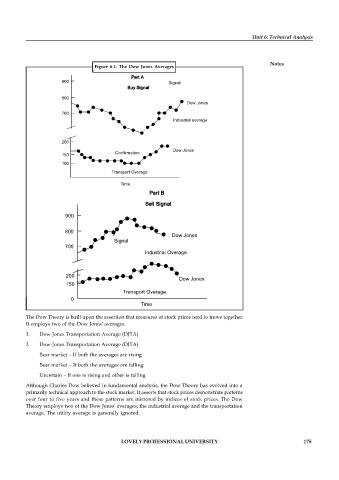

Figure 6.1: The Dow Jones Averages

Part A

900 Signal

Buy Signal

800

Dow Jones

700

Industrial average

200

Dow Jones

Confirmation

150

100

Transport Overage

Time

Part B

Sell Signal

Part B

900

SELL SIGNAL

800 Dow Jones

900 Signal

800 700

Dow Jones

Industrial Overage

Signal

700

Industrial Overage

200 Dow Jones

200 150

Dow Jones

150 Transport Overage

0

Transport overage

Time

0

The Dow Theory is built upon the assertion that measures of stock prices tend to move together.

Time

It employs two of the Dow Jones' averages.

Dow-Jones Transportation Average (DJTA)

1. Figure 1: The Dow Jones Averages

2. Dow-Jones Transportation Average (DJTA)

Bear market – If both the averages are rising

Bear market – If both the averages are falling

Uncertain – If one is rising and other is falling

Although Charles Dow believed in fundamental analysis, the Dow Theory has evolved into a

primarily technical approach to the stock market. It asserts that stock prices demonstrate patterns

over four to five years and these patterns are mirrored by indices of stock prices. The Dow

Theory employs two of the Dow Jones' averages, the industrial average and the transportation

average. The utility average is generally ignored.

LOVELY PROFESSIONAL UNIVERSITY 175