Page 210 - DCOM504_SECURITY_ANALYSIS_AND_PORTFOLIO_MANAGEMENT

P. 210

Unit 7: Efficient Market Theory

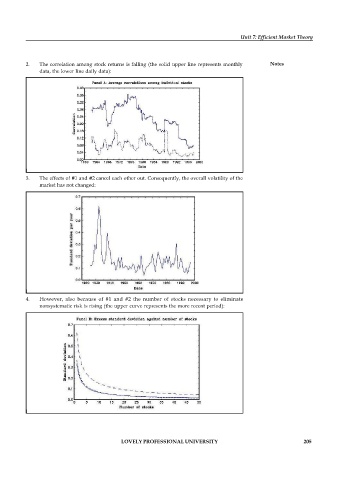

2. The correlation among stock returns is falling (the solid upper line represents monthly Notes

data, the lower line daily data):

3. The effects of #1 and #2 cancel each other out. Consequently, the overall volatility of the

market has not changed:

4. However, also because of #1 and #2 the number of stocks necessary to eliminate

nonsystematic risk is rising (the upper curve represents the more recent period):

LOVELY PROFESSIONAL UNIVERSITY 205