Page 87 - DCOM504_SECURITY_ANALYSIS_AND_PORTFOLIO_MANAGEMENT

P. 87

Security Analysis and Portfolio Management

Notes

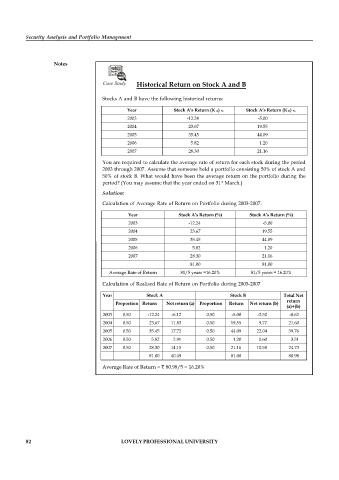

Case Study Historical Return on Stock A and B

Stocks A and B have the following historical returns:

Year Stock A’s Return (K A) % Stock A’s Return (K B) %

2003 -12.24 -5.00

2004 23.67 19.55

2005 35.45 44.09

2006 5.82 1.20

2007 28.30 21.16

You are required to calculate the average rate of return for each stock during the period

2003 through 2007. Assume that someone held a portfolio consisting 50% of stock A and

50% of stock B. What would have been the average return on the portfolio during the

period? (You may assume that the year ended on 31 March.)

st

Solution:

Calculation of Average Rate of Return on Portfolio during 2003-2007.

Year Stock A’s Return (%) Stock A’s Return (%)

2003 -12.24 -5.00

2004 23.67 19.55

2005 35.45 44.09

2006 5.82 1.20

2007 28.30 21.16

81.00 81.00

Average Rate of Return 81/5 years =16.20% 81/5 years = 16.20%

Calculation of Realised Rate of Return on Portfolio during 2003-2007

Year Stock A Stock B Total Net

return

Proportion Return Net return (a) Proportion Return Net return (b)

(a)+(b)

2003 0.50 -12.24 -6.12 0.50 -5.00 -2.50 -8.62

2004 0.50 23.67 11.83 0.50 19.55 9.77 21.60

2005 0.50 35.45 17.72 0.50 44.09 22.04 39.76

2006 0.50 5.82 2.91 0.50 1.20 0.60 3.51

2007 0.50 28.30 14.15 0.50 21.16 10.58 24.73

81.00 40.49 81.00 80.98

Average Rate of Return = 80.98/5 = 16.20%

82 LOVELY PROFESSIONAL UNIVERSITY