Page 226 - DCOM505_WORKING_CAPITAL_MANAGEMENT

P. 226

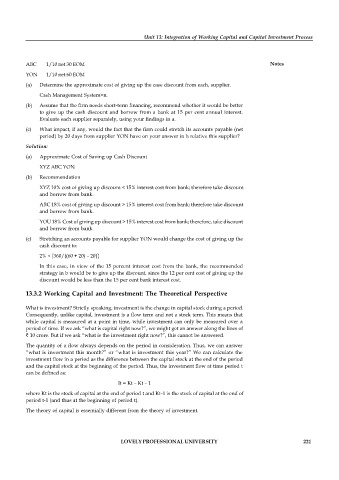

Unit 13: Integration of Working Capital and Capital Investment Process

ABC 1/10 net 30 EOM Notes

YON 1/10 net 60 EOM

(a) Determine the approximate cost of giving up the case discount from each, supplier.

Cash Management System>n.

(b) Assume that the firm needs short-term financing, recommend whether it would be better

to give up the cash discount and borrow from a bank at 15 per cent annual interest.

Evaluate each supplier separately, using your findings in a.

(c) What impact, if any, would the fact that the firm could stretch its accounts payable (net

period) by 20 days from supplier YON have on your answer in h relative this supplier?

Solution:

(a) Approximate Cost of Saving up Cash Discount

XYZ ABC YON

(b) Recommendation

XYZ 10% cost of giving up discount < 15% interest cost from bank; therefore take discount

and borrow from bank.

ABC 18% cost of giving up discount > 15% interest cost from bank; therefore take discount

and borrow from bank.

YOU 18% Cost of giving up discount > 15% interest cost from bank; therefore, take discount

and borrow from bank.

(c) Stretching an accounts payable for supplier YON would change the cost of giving up the

cash discount to:

2% × [360/{(60 + 20) – 20}]

In this case, in view of the 15 percent interest cost from the bank, the recommended

strategy in b would be to give up the discount, since the 12 per cent cost of giving up the

discount would be less than the 15 per cent bank interest cost.

13.3.2 Working Capital and Investment: The Theoretical Perspective

What is investment? Strictly speaking, investment is the change in capital stock during a period.

Consequently, unlike capital, investment is a flow term and not a stock term. This means that

while capital is measured at a point in time, while investment can only be measured over a

period of time. If we ask “what is capital right now?”, we might get an answer along the lines of

` 10 crore. But if we ask “what is the investment right now?”, this cannot be answered.

The quantity of a flow always depends on the period in consideration. Thus, we can answer

“what is investment this month?” or “what is investment this year?” We can calculate the

investment flow in a period as the difference between the capital stock at the end of the period

and the capital stock at the beginning of the period. Thus, the investment flow at time period t

can be defined as:

It = Kt – Kt – 1

where Kt is the stock of capital at the end of period t and Kt–1 is the stock of capital at the end of

period t-1 (and thus at the beginning of period t).

The theory of capital is essentially different from the theory of investment.

LOVELY PROFESSIONAL UNIVERSITY 221