Page 102 - DCOM508_CORPORATE_TAX_PLANNING

P. 102

Unit 4: Set-off and Carry Forward of Losses

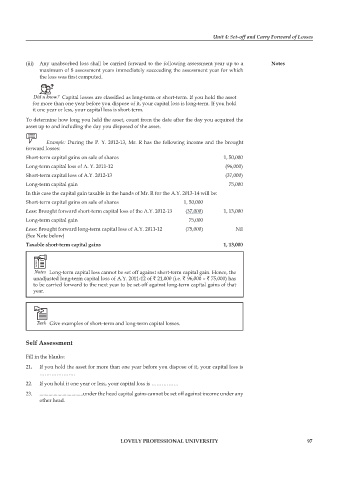

(iii) Any unabsorbed loss shall be carried forward to the following assessment year up to a Notes

maximum of 8 assessment years immediately succeeding the assessment year for which

the loss was fi rst computed.

Did u know? Capital losses are classifi ed as long-term or short-term. If you hold the asset

for more than one year before you dispose of it, your capital loss is long-term. If you hold

it one year or less, your capital loss is short-term.

To determine how long you held the asset, count from the date after the day you acquired the

asset up to and including the day you disposed of the asset.

Example: During the P. Y. 2012-13, Mr. R has the following income and the brought

forward losses:

Short-term capital gains on sale of shares 1, 50,000

Long-term capital loss of A. Y. 2011-12 (96,000)

Short-term capital loss of A.Y. 2012-13 (37,000)

Long-term capital gain 75,000

In this case the capital gain taxable in the hands of Mr. R for the A.Y. 2013-14 will be:

Short-term capital gains on sale of shares 1, 50,000

Less: Brought forward short-term capital loss of the A.Y. 2012-13 (37,000) 1, 13,000

Long-term capital gain 75,000

Less: Brought forward long-term capital loss of A.Y. 2011-12 (75,000) Nil

(See Note below)

Taxable short-term capital gains 1, 13,000

Notes Long-term capital loss cannot be set off against short-term capital gain. Hence, the

unadjusted long-term capital loss of A.Y. 2011-12 of ` 21,000 (i.e. ` 96,000 – ` 75,000) has

to be carried forward to the next year to be set-off against long-term capital gains of that

year.

Task Give examples of short-term and long-term capital losses.

Self Assessment

Fill in the blanks:

21. If you hold the asset for more than one year before you dispose of it, your capital loss is

…………………

22. If you hold it one year or less, your capital loss is …………….

23. ..................................under the head capital gains cannot be set off against income under any

other head.

LOVELY PROFESSIONAL UNIVERSITY 97