Page 107 - DCOM508_CORPORATE_TAX_PLANNING

P. 107

Corporate Tax Planning

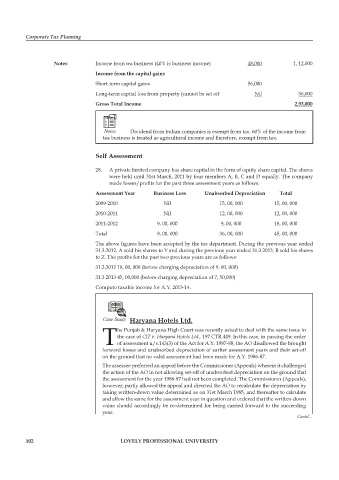

Notes Income from tea business (40% is business income) 48,000 1, 12,000

Income from the capital gains

Short-term capital gains 56,000

Long-term capital loss from property (cannot be set off Nil 56,000

Gross Total Income 2,93,000

Notes Dividend from Indian companies is exempt from tax. 60% of the income from

tea business is treated as agricultural income and therefore, exempt from tax.

Self Assessment

28. A private limited company has share capital in the form of equity share capital. The shares

were held until 31st March, 2011 by four members A, B, C and D equally. The company

made losses/profits for the past three assessment years as follows:

Assessment Year Business Loss Unabsorbed Depreciation Total

2009-2010 Nil 15, 00, 000 15, 00, 000

2010-2011 Nil 12, 00, 000 12, 00, 000

2011-2012 9, 00, 000 9, 00, 000 18, 00, 000

Total 9, 00, 000 36, 00, 000 45, 00, 000

The above figures have been accepted by the tax department. During the previous year ended

31.3.2012, A sold his shares to Y and during the previous year ended 31.3.2013, B sold his shares

to Z. The profits for the past two previous years are as follows:

31.3.2012 18, 00, 000 (before charging depreciation of 9, 00, 000)

31.3.2013 45, 00,000 (before charging depreciation of 7, 50,000)

Compute taxable income for A.Y. 2013-14.

Case Study Haryana Hotels Ltd.

he Punjab & Haryana High Court was recently asked to deal with the same issue in

the case of CIT v. Haryana Hotels Ltd., 197 CTR 449. In this case, in passing the order

Tof assessment u/s.143(3) of the Act for A.Y. 1987-88, the AO disallowed the brought

forward losses and unabsorbed depreciation of earlier assessment years and their set-off

on the ground that no valid assessment had been made for A.Y. 1986-87.

The assessee preferred an appeal before the Commissioner (Appeals) wherein it challenged

the action of the AO in not allowing set-off of unabsorbed depreciation on the ground that

the assessment for the year 1986-87 had not been completed. The Commissioner (Appeals),

however, partly allowed the appeal and directed the AO to recalculate the depreciation by

taking written-down value determined as on 31st March 1985, and thereafter to calculate

and allow the same for the assessment year in question and ordered that the written-down

value should accordingly be re-determined for being carried forward to the succeeding

year.

Contd...

102 LOVELY PROFESSIONAL UNIVERSITY