Page 112 - DCOM508_CORPORATE_TAX_PLANNING

P. 112

Unit 4: Set-off and Carry Forward of Losses

be carried in the same manner. There were business losses of ` 4.25 Lakhs till 31.03.2012. Notes

The net results of the business for the year ended 31.03.2013 were profi ts of ` 5 Lakhs.

The partners want to set off the losses of ` 4.25 Lakhs from the profits of the firm. Can they

do so?

16. X Ltd., a pharmaceutical company having accumulated losses and unabsorbed depreciation

to be set off in future for ` 130 lakhs and ` 250 lakhs as on 31.3.2012 was demerged on

16.5.2012 and 30% of its total assets were transferred to the resulting company, XY Ltd.

How shall the accumulated losses and unabsorbed depreciation of the demerged company

be dealt with in the return for Assessment Year 2013-14 of the resulting company:

(a) When the same are not directly relatable to the undertakings transferred and

(b) When the same are directly relatable to the undertakings transferred.

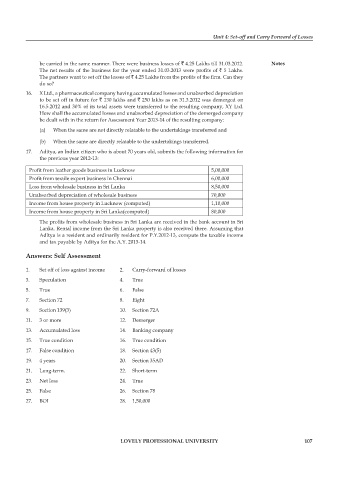

17. Aditya, an Indian citizen who is about 70 years old, submits the following information for

the previous year 2012-13:

Profit from leather goods business in Lucknow 5,00,000

Profit from textile export business in Chennai 6,00,000

Loss from wholesale business in Sri Lanka 8,50,000

Unabsorbed depreciation of wholesale business 70,000

Income from house property in Lucknow (computed) 1,10,000

Income from house property in Sri Lanka(computed) 80,000

The profits from wholesale business in Sri Lanka are received in the bank account in Sri

Lanka. Rental income from the Sri Lanka property is also received there. Assuming that

Aditya is a resident and ordinarily resident for P.Y.2012-13, compute the taxable income

and tax payable by Aditya for the A.Y. 2013-14.

Answers: Self Assessment

1. Set off of loss against income 2. Carry-forward of losses

3. Speculation 4. True

5. True 6. False

7. Section 72 8. Eight

9. Section 139(3) 10. Section 72A

11. 3 or more 12. Demerger

13. Accumulated loss 14. Banking company

15. True condition 16. True condition

17. False condition 18. Section 43(5)

19. 4 years 20. Section 35AD

21. Long-term. 22. Short-term

23. Net loss 24. True

25. False 26. Section 78

27. BOI 28. 1,50,000

LOVELY PROFESSIONAL UNIVERSITY 107