Page 233 - DCOM508_CORPORATE_TAX_PLANNING

P. 233

Corporate Tax Planning

Notes

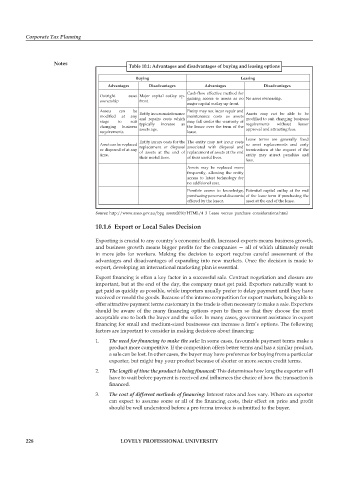

Table 10.1: Advantages and disadvantages of buying and leasing options

Buying Leasing

Advantages Disadvantages Advantages Disadvantages

Cash-flow effective method for

Outright asset Major capital outlay up-

ownership front. gaining access to assets as no No asset ownership.

major capital outlay up-front.

Assets can be Entity may not incur repair and

modifi ed at any Entity incurs maintenance maintenance costs as assets Assets may not be able to be

stage to suit and repairs costs which may fall under the warranty of modified to suit changing business

changing business typically increase as the lessor over the term of the requirements without lessor

requirements. assets age. lease. approval and attracting fees.

Lease terms are generally fi xed

Entity incurs costs for the The entity may not incur costs

Asset can be replaced replacement or disposal associated with disposal and so asset replacements and early

or disposed of at any of assets at the end of replacement of assets at the end terminations at the request of the

time. entity may attract penalties and

their useful lives. of their useful lives.

fees.

Assets may be replaced more

frequently, allowing the entity

access to latest technology for

no additional cost.

Possible access to knowledge, Potential capital outlay at the end

purchasing power and discounts of the lease term if purchasing the

offered by the lessor. asset at the end of the lease.

Source: http://www.anao.gov.au/bpg_assets2010/HTML/4_3_Lease_versus_purchase_considerations.html

10.1.6 Export or Local Sales Decision

Exporting is crucial to any country’s economic health. Increased exports means business growth,

and business growth means bigger profits for the companies — all of which ultimately result

in more jobs for workers. Making the decision to export requires careful assessment of the

advantages and disadvantages of expanding into new markets. Once the decision is made to

export, developing an international marketing plan is essential.

Export financing is often a key factor in a successful sale. Contract negotiation and closure are

important, but at the end of the day, the company must get paid. Exporters naturally want to

get paid as quickly as possible, while importers usually prefer to delay payment until they have

received or resold the goods. Because of the intense competition for export markets, being able to

offer attractive payment terms customary in the trade is often necessary to make a sale. Exporters

should be aware of the many financing options open to them so that they choose the most

acceptable one to both the buyer and the seller. In many cases, government assistance in export

financing for small and medium-sized businesses can increase a firm’s options. The following

factors are important to consider in making decisions about fi nancing:

1. The need for financing to make the sale: In some cases, favourable payment terms make a

product more competitive. If the competition offers better terms and has a similar product,

a sale can be lost. In other cases, the buyer may have preference for buying from a particular

exporter, but might buy your product because of shorter or more secure credit terms.

2. The length of time the product is being fi nanced: This determines how long the exporter will

have to wait before payment is received and influences the choice of how the transaction is

fi nanced.

3. The cost of different methods of fi nancing: Interest rates and fees vary. Where an exporter

can expect to assume some or all of the financing costs, their effect on price and profi t

should be well understood before a pro forma invoice is submitted to the buyer.

228 LOVELY PROFESSIONAL UNIVERSITY