Page 238 - DCOM508_CORPORATE_TAX_PLANNING

P. 238

Unit 10: Tax Consideration in Specific Managerial Decisions

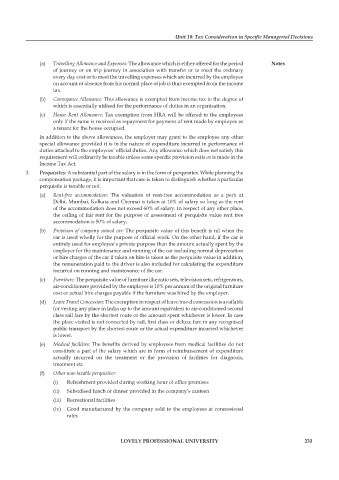

(a) Travelling Allowance and Expenses: The allowance which is either offered for the period Notes

of journey or on trip journey in association with transfer or to meet the ordinary

every day cost or to meet the travelling expenses which are incurred by the employee

on account of absence from his normal place of job is thus exempted from the income

tax.

(b) Conveyance Allowance: This allowance is exempted from income tax to the degree of

which is essentially utilised for the performance of duties in an organisation.

(c) House Rent Allowance: Tax exemption from HRA will be offered to the employees

only if the same is received as repayment for payment of rent made by employee as

a tenant for the house occupied.

In addition to the above allowances, the employer may grant to the employee any other

special allowance provided it is in the nature of expenditure incurred in performance of

duties attached to the employees’ official duties. Any allowance which does not satisfy this

requirement will ordinarily be taxable unless some specific provision exits or is made in the

Income Tax Act.

3. Perquisites: A substantial part of the salary is in the form of perquisites. While planning the

compensation package, it is important that care is taken to distinguish whether a particular

perquisite is taxable or not.

(a) Rent-free accommodation: The valuation of rent-free accommodation as a perk at

Delhi, Mumbai, Kolkata and Chennai is taken at 10% of salary so long as the rent

of the accommodation does not exceed 60% of salary. In respect of any other place,

the ceiling of fair rent for the purpose of assessment of perquisite value rent free

accommodation is 50% of salary.

(b) Provision of company owned car: The perquisite value of this benefit is nil when the

car is used wholly for the purpose of official work. On the other hand, if the car is

entirely used for employee’s private purpose than the amount actually spent by the

employer for the maintenance and running of the car including normal depreciation

or hire charges of the car if taken on hire is taken as the perquisite value in addition,

the remuneration paid to the driver is also included for calculating the expenditure

incurred on running and maintenance of the car.

(c) Furniture: The perquisite value of furniture like ratio sets, television sets, refrigerators,

air-conditioners provided by the employer is 10% per annum of the original furniture

cost or actual hire charges payable if the furniture was hired by the employer.

(d) Leave Travel Concession: The exemption in respect of leave travel concession is available

for vesting any place in India up to the amount equivalent to air-conditioned second

class rail fare by the shortest route or the amount spent whichever is lower. In case

the place visited is not connected by rail, first class or deluxe fare in any recognised

public transport by the shortest route or the actual expenditure incurred whichever

is lower.

(e) Medical facilities: The benefits derived by employees from medical facilities do not

constitute a part of the salary which are in form of reimbursement of expenditure

actually incurred on the treatment or the provision of facilities for diagnosis,

treatment etc

(f) Other non-taxable perquisites:

(i) Refreshment provided during working hour of offi ce premises

(ii) Subsidised lunch or dinner provided in the company’s canteen

(iii) Recreational facilities

(iv) Good manufactured by the company sold to the employees at concessional

rates

LOVELY PROFESSIONAL UNIVERSITY 233