Page 240 - DCOM508_CORPORATE_TAX_PLANNING

P. 240

Unit 10: Tax Consideration in Specific Managerial Decisions

10. Any subscription made to deposits or any contribution made the National Housing Notes

Bank’s Pension Funds.

10.2.2 Fixation of Tax Liability

In India the income tax payable under the head salaries is imposed by Government of India for

individuals, firms, trusts, co-operative societies and any other artificial person. The tax is levied

differently on every person depending on the components of his compensation package. The Tax

is levied by the department of Central Board of Direct Taxes (CBDT), acting as a part of Ministry

of Finance as governed by the Income Tax Act, 1961.

The taxes on salaries or any other income of individual is fixed after a combined working of

different income tax Acts, rules, notifications and legal decisions taken in court concerning that

head of income.

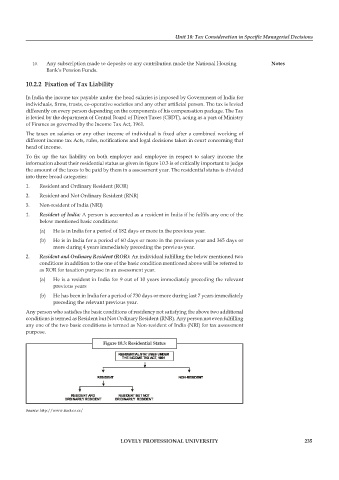

To fix up the tax liability on both employer and employee in respect to salary income the

information about their residential status as given in figure 10.3 is of critically important to judge

the amount of the taxes to be paid by them in a assessment year. The residential status is divided

into three broad categories:

1. Resident and Ordinary Resident (ROR)

2. Resident and Not Ordinary Resident (RNR)

3. Non-resident of India (NRI)

1. Resident of India: A person is accounted as a resident in India if he fulfils any one of the

below mentioned basic conditions:

(a) He is in India for a period of 182 days or more in the previous year.

(b) He is in India for a period of 60 days or more in the previous year and 365 days or

more during 4 years immediately preceding the previous year.

2. Resident and Ordinary Resident (ROR): An individual fulfilling the below mentioned two

conditions in addition to the one of the basic condition mentioned above will be referred to

as ROR for taxation purpose in an assessment year.

(a) He is a resident in India for 9 out of 10 years immediately preceding the relevant

previous years

(b) He has been in India for a period of 730 days or more during last 7 years immediately

preceding the relevant previous year.

Any person who satisfies the basic conditions of residency not satisfying the above two additional

conditions is termed as Resident but Not Ordinary Resident (RNR). Any person not even fulfi lling

any one of the two basic conditions is termed as Non-resident of India (NRI) for tax assessment

purpose.

Figure 10.3: Residential Status

Source: http://www.itact.co.cc/

LOVELY PROFESSIONAL UNIVERSITY 235