Page 241 - DCOM508_CORPORATE_TAX_PLANNING

P. 241

Corporate Tax Planning

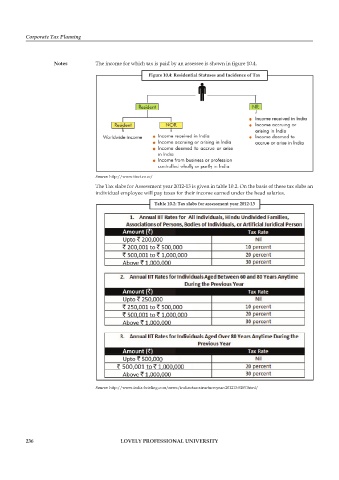

Notes The income for which tax is paid by an assessee is shown in fi gure 10.4.

Figure 10.4: Residential Statuses and Incidence of Tax

Source: http://www.itact.co.cc/

The Tax slabs for Assessment year 2012-13 is given in table 10.2. On the basis of these tax slabs an

individual employee will pay taxes for their income earned under the head salaries.

Table 10.2: Tax slabs for assessment year 2012-13

0

` 500,001

Source: http://www.india-briefi ng.com/news/indias-tax-structure-year-201213-5297.html/

236 LOVELY PROFESSIONAL UNIVERSITY