Page 236 - DCOM508_CORPORATE_TAX_PLANNING

P. 236

Unit 10: Tax Consideration in Specific Managerial Decisions

Notes

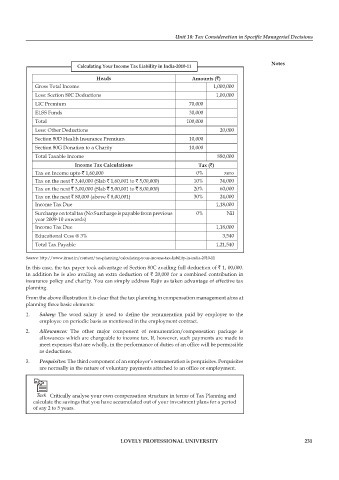

Calculating Your Income Tax Liability in India-2010-11

Heads Amounts (`)

Gross Total Income 1,000,000

Less: Section 80C Deductions 1,00,000

LIC Premium 70,000

ELSS Funds 30,000

Total 100,000

Less: Other Deductions 20,000

Section 80D Health Insurance Premium 10,000

Section 80G Donation to a Charity 10,000

Total Taxable Income 880,000

Income Tax Calculations Tax (`)

Tax on Income upto ` 1,60,000 0% zero

Tax on the next ` 3,40,000 (Slab ` 1,60,001 to ` 5,00,000) 10% 34,000

Tax on the next ` 3,00,000 (Slab ` 5,00,001 to ` 8,00,000) 20% 60,000

Tax on the next ` 80,000 (above ` 8,00,001) 30% 24,000

Income Tax Due 1,18,000

Surcharge on total tax (No Surcharge is payable from previous 0% Nil

year 2009-10 onwards)

Income Tax Due 1,18,000

Educational Cess @ 3% 3,540

Total Tax Payable 1,21,540

Source: http://www.itrust.in/content/tax-planning/calculating-your-income-tax-liability-in-india-2010-11

In this case, the tax payer took advantage of Section 80C availing full deduction of ` 1, 00,000.

In addition he is also availing an extra deduction of ` 20,000 for a combined contribution in

insurance policy and charity. You can simply address Rajiv as taken advantage of effective tax

planning.

From the above illustration it is clear that the tax planning in compensation management aims at

planning three basic elements:

1. Salary: The word salary is used to define the remuneration paid by employer to the

employee on periodic basis as mentioned in the employment contract.

2. Allowances: The other major component of remuneration/compensation package is

allowances which are chargeable to income tax. If, however, such payments are made to

meet expenses that are wholly, in the performance of duties of an office will be permissible

as deductions.

3. Perquisites: The third component of an employer’s remuneration is perquisites. Perquisites

are normally in the nature of voluntary payments attached to an office or employment.

Task Critically analyse your own compensation structure in terms of Tax Planning and

calculate the savings that you have accumulated out of your investment plans for a period

of say 2 to 5 years.

LOVELY PROFESSIONAL UNIVERSITY 231