Page 127 - DCOM510_FINANCIAL_DERIVATIVES

P. 127

Financial Derivatives

Notes The figure 8.2 shows the profits/losses from a short position on the index. The investor sold the

index at 2220. If the index falls, there are profits, else losses.

Payoff Profile for Buyer of Call Options: Long Call

A call option gives the buyer the right to buy the underlying asset at the strike price specified in

the option. The profit/loss that the buyer makes on the option depends on the spot price of the

underlying. If upon expiration, the spot price of the underlying is less than the strike price, he

lets his option expire unexercised. His loss in this case is the premium he paid for buying option.

Figure 8.3 gives the payoff for the buyer of a three month call option (often referred to as long

call) with a strike of 2250 bought at a premium of 86.60.

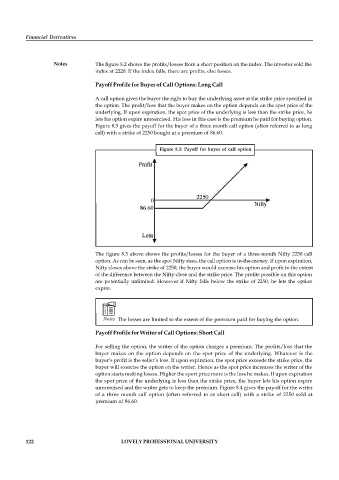

Figure 8.3: Payoff for buyer of call option

The figure 8.3 above shows the profits/losses for the buyer of a three-month Nifty 2250 call

option. As can be seen, as the spot Nifty rises, the call option is in-the-money. If upon expiration,

Nifty closes above the strike of 2250, the buyer would exercise his option and profit to the extent

of the difference between the Nifty-close and the strike price. The profits possible on this option

are potentially unlimited. However if Nifty falls below the strike of 2250, he lets the option

expire.

Notes The losses are limited to the extent of the premium paid for buying the option.

Payoff Profile for Writer of Call Options: Short Call

For selling the option, the writer of the option charges a premium. The profits/loss that the

buyer makes on the option depends on the spot price of the underlying. Whatever is the

buyer’s profit is the seller’s loss. If upon expiration, the spot price exceeds the strike price, the

buyer will exercise the option on the writer. Hence as the spot price increases the writer of the

option starts making losses. Higher the sport price more is the loss he makes. If upon expiration

the spot price of the underlying is less than the strike price, the buyer lets his option expire

unexercised and the writer gets to keep the premium. Figure 8.4 gives the payoff for the writer

of a three month call option (often referred to as short call) with a strike of 2250 sold at

premium of 86.60.

122 LOVELY PROFESSIONAL UNIVERSITY