Page 151 - DMGT409Basic Financial Management

P. 151

Basic Financial Management

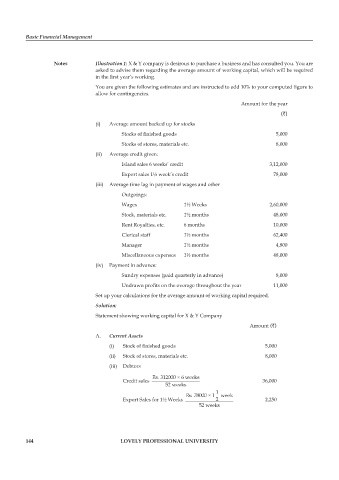

Notes Illustration 1: X & Y company is desirous to purchase a business and has consulted you. You are

asked to advise them regarding the average amount of working capital, which will be required

in the first year’s working.

You are given the following estimates and are instructed to add 10% to your computed fi gure to

allow for contingencies.

Amount for the year

(`)

(i) Average amount backed up for stocks

Stocks of fi nished goods 5,000

Stocks of stores, materials etc. 8,000

(ii) Average credit given:

Island sales 6 weeks’ credit 3,12,000

Export sales 1½ week’s credit 78,000

(iii) Average time lag in payment of wages and other

Outgoings:

Wages 1½ Weeks 2,60,000

Stock, materials etc. 1½ months 48,000

Rent Royalties, etc. 6 months 10,000

Clerical staff 1½ months 62,400

Manager 1½ months 4,800

Miscellaneous expenses 1½ months 48,000

(iv) Payment in advance:

Sundry expenses (paid quarterly in advance) 8,000

Undrawn profits on the overage throughout the year 11,000

Set up your calculations for the average amount of working capital required.

Solution:

Statement showing working capital for X & Y Company

Amount (`)

A. Current Assets

(i) Stock of fi nished goods 5,000

(ii) Stock of stores, materials etc. 8,000

(iii) Debtors

Credit sales 36,000

Export Sales for 1½ Weeks 2,250

144 LOVELY PROFESSIONAL UNIVERSITY