Page 153 - DMGT409Basic Financial Management

P. 153

Basic Financial Management

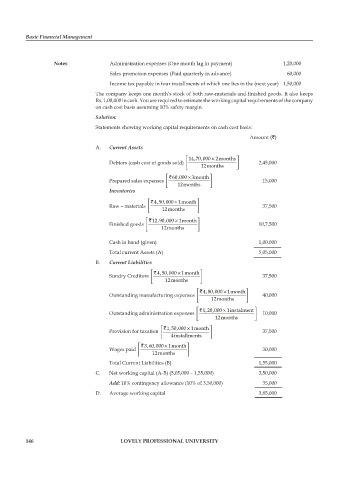

Notes Administration expenses (One month lag in payment) 1,20,000

Sales promotion expenses (Paid quarterly in advance) 60,000

Income tax payable in four installments of which one lies in the (next year) 1,50,000

The company keeps one month’s stock of both raw-materials and finished goods. It also keeps

Rs. 1,00,000 in cash. You are required to estimate the working capital requirements of the company

on cash cost basis assuming 10% safety margin.

Solution:

Statements showing working capital requirements on cash cost basis:

Amount (`)

A. Current Assets

⎡ 14,70,000 2months⎤

×

Debtors (cash cost of goods sold) ⎢ ⎥ 2,45,000

⎣ 12months ⎦

×

⎡ ` 60,000 3month ⎤

Prepared sales expenses ⎢ ⎥ 15,000

⎣ 12months ⎦

Inventories

×

⎡ ` 4,50,000 1month ⎤

Raw – materials ⎢ ⎥ 37,500

⎣ 12months ⎦

×

⎡ ` 12,90,000 1month ⎤

Finished goods ⎢ ⎥ 10,7,500

⎣ 12months ⎦

Cash in hand (given) 1,00,000

Total current Assets (A) 5,05,000

B. Current Liabilities

⎡ ` 4,50,000 1month ⎤

×

Sundry Creditors ⎢ ⎥ 37,500

⎣ 12months ⎦

×

⎡ ` 4,80,000 1month ⎤

Outstanding manufacturing expenses ⎢ ⎥ 40,000

⎣ 12months ⎦

×

⎡ ` 1,20,000 1instalment ⎤

Outstanding administration expenses ⎢ ⎥ 10,000

⎣ 12months ⎦

×

⎡ ` 1,50,000 1month ⎤

Provision for taxation ⎢ ⎥ 37,500

⎣ 4installments ⎦

×

⎡ ` 3,60,000 1month ⎤

Wages paid ⎢ ⎥ 30,000

⎣ 12months ⎦

Total Current Liabilities (B) 1,55,000

C. Net working capital (A-B) (5,05,000 – 1,55,000) 3,50,000

Add: 10% contingency allowance (10% of 3,50,000) 35,000

D. Average working capital 3,85,000

146 LOVELY PROFESSIONAL UNIVERSITY