Page 145 - DMGT104_FINANCIAL_ACCOUNTING

P. 145

Unit 7: Trial Balance

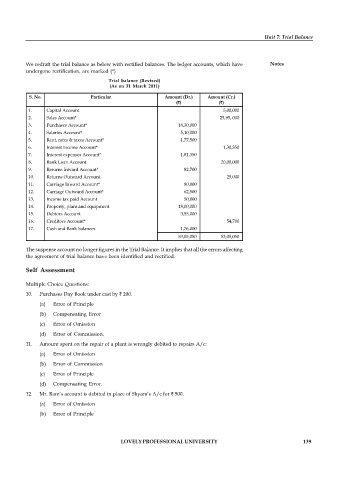

We redraft the trial balance as below with rectified balances. The ledger accounts, which have Notes

undergone rectification, are marked (*)

Trial balance (Revised)

(As on 31 March 2011)

S. No. Particular Amount (Dr.) Amount (Cr.)

( ) ( )

1. Capital Account 5,00,000

2. Sales Account* 25,95, 000

3. Purchases Account* 18,30,000

4. Salaries Account* 5,10,000

5. Rent, rates & taxes Account* 1,77,500

6. Interest income Account* 1,30,350

7. Interest expenses Account* 1,81,350

8. Bank Loan Account 20,00,000

9. Returns Inward Account* 82,700

10. Returns Outward Account 25,000

11. Carriage Inward Account* 80,000

12. Carriage Outward Account* 62,500

13. Income tax paid Account 50,000

14. Property, plant and equipment 18,00,000

15. Debtors Account 3,55,000

16. Creditors Account* 54,700

17. Cash and Bank balances 1,76,000

53,05,050 53,05,050

The suspense account no longer figures in the Trial Balance. It implies that all the errors affecting

the agreement of trial balance have been identified and rectified.

Self Assessment

Multiple Choice Questions:

10. Purchases Day Book under cast by 200.

(a) Error of Principle

(b) Compensating Error

(c) Error of Omission

(d) Error of Commission.

11. Amount spent on the repair of a plant is wrongly debited to repairs A/c:

(a) Error of Omission

(b) Error of Commission

(c) Error of Principle

(d) Compensating Error.

12. Mr. Ram’s account is debited in place of Shyam’s A/c for 500.

(a) Error of Omission

(b) Error of Principle

LOVELY PROFESSIONAL UNIVERSITY 139