Page 141 - DMGT104_FINANCIAL_ACCOUNTING

P. 141

Unit 7: Trial Balance

Effects on the profit for the year 2006: Notes

(a) No effect.

(b) Net profit is higher by 50.

(c) Gross profit and Net profit is reduced by 91.

(d) Net profit is higher by 60.

(e) Net Profit is reduced by 540.

(f) Net profit is lower by 200.

The total effect of all errors on profit is 721 i.e. profit is lower to the extent of 721 and if

corrected, Net profit increase by 721.

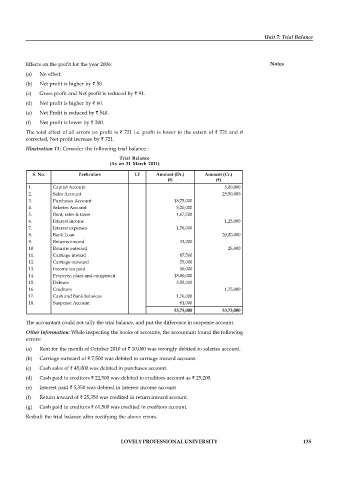

Illustration 11: Consider the following trial balance :

Trial Balance

(As on 31 March 2011)

S. No. Particulars LF Amount (Dr.) Amount (Cr.)

( ) ( )

1. Capital Account 5,00,000

2. Sales Account 25,50,000

3. Purchases Account 18,75,000

4. Salaries Account 5,20,000

5. Rent, rates & taxes 1,67,500

6. Interest income 1,25,000

7. Interest expenses 1,76,000

8. Bank Loan 20,00,000

9. Returns inward 32,000

10. Returns outward 25,000

11. Carriage inward 87,500

12. Carriage outward 55,000

13. Income tax paid 50,000

14. Property, plant and equipment 18,00,000

15. Debtors 3,55,000

16. Creditors 1,75,000

17. Cash and Bank balances 1,76,000

18. Suspense Account 81,000

53,75,000 53,75,000

The accountant could not tally the trial balance, and put the difference in suspense account.

Other Information: While inspecting the books of accounts, the accountant found the following

errors:

(a) Rent for the month of October 2010 of 10,000 was wrongly debited to salaries account.

(b) Carriage outward of 7,500 was debited to carriage inward account.

(c) Cash sales of 45,000 was debited in purchases account.

(d) Cash paid to creditors 22,500 was debited to creditors account as 25,200.

(e) Interest paid 5,350 was debited in interest income account

(f) Return inward of 25,350 was credited in return inward account.

(g) Cash paid to creditors 61,500 was credited in creditors account.

Redraft the trial balance after rectifying the above errors.

LOVELY PROFESSIONAL UNIVERSITY 135