Page 223 - DMGT104_FINANCIAL_ACCOUNTING

P. 223

Unit 10: Accounting and Depreciation for Fixed Assets

Foundation charges 3,00,000 Notes

Installation charges 5,00,000

The company borrowed a sum of 360 lakh from HDFC Bank at 16% interest per annum. The

machinery was ready for use on 31st March, 2008. Ascertain the cost of machinery.

Solution:

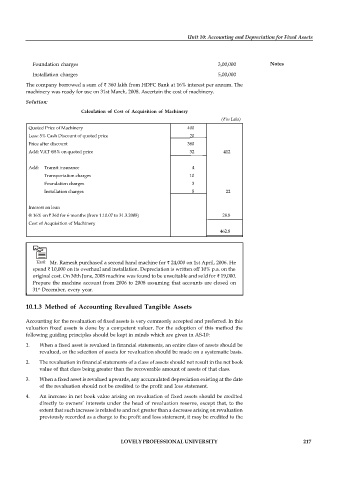

Calculation of Cost of Acquisition of Machinery

( in Laks)

Quoted Price of Machinery 400

Less: 5% Cash Discount of quoted price 20

Price after discount 380

Add: VAT @8% on quoted price 32 412

Add: Transit insurance 4

Transportation charges 10

Foundation charges 3

Installation charges 5 22

Interest on loan

@ 16% on 360 for 6 months (from 1.10.07 to 31.3.2008) 28.8

Cost of Acquisition of Machinery

462.8

Task Mr. Ramesh purchased a second hand machine for 24,000 on 1st April, 2006. He

spend 10,000 on its overhaul and installation. Depreciation is written off 10% p.a. on the

original cost. On 30th June, 2008 machine was found to be unsuitable and sold for 19,000.

Prepare the machine account from 2006 to 2008 assuming that accounts are closed on

31 December, every year.

st

10.1.3 Method of Accounting Revalued Tangible Assets

Accounting for the revaluation of fixed assets is very commonly accepted and preferred. In this

valuation fixed assets is done by a competent valuer. For the adoption of this method the

following guiding principles should be kept in minds which are given in AS-10:

1. When a fixed asset is revalued in financial statements, an entire class of assets should be

revalued, or the selection of assets for revaluation should be made on a systematic basis.

2. The revaluation in financial statements of a class of assets should not result in the net book

value of that class being greater than the recoverable amount of assets of that class.

3. When a fixed asset is revalued upwards, any accumulated depreciation existing at the date

of the revaluation should not be credited to the profit and loss statement.

4. An increase in net book value arising on revaluation of fixed assets should be credited

directly to owners’ interests under the head of revaluation reserve, except that, to the

extent that such increase is related to and not greater than a decrease arising on revaluation

previously recorded as a charge to the profit and loss statement, it may be credited to the

LOVELY PROFESSIONAL UNIVERSITY 217