Page 112 - DMGT202_COST_AND_MANAGEMENT_ACCOUNTING

P. 112

Unit 6: Marginal Costing and Absorption Costing

Determining optimum level of operations: Under this method, the level has to be found out Notes

which is having lesser selling price, cost of operations and greater profits known as optimum

level of operations

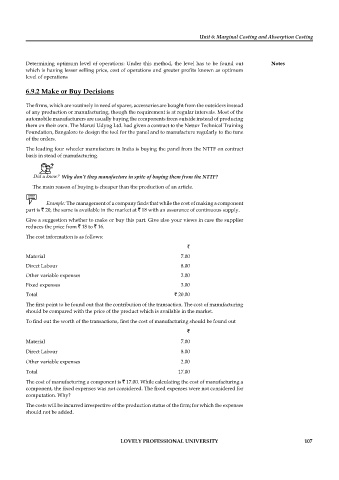

6.9.2 Make or Buy Decisions

The firms, which are routinely in need of spares, accessories are bought from the outsiders instead

of any production or manufacturing, though the requirement is at regular intervals. Most of the

automobile manufacturers are usually buying the components from outside instead of producing

them on their own. The Maruti Udyog Ltd. had given a contract to the Nettur Technical Training

Foundation, Bangalore to design the tool for the panel and to manufacture regularly to the tune

of the orders.

The leading four wheeler manufacture in India is buying the panel from the NTTF on contract

basis in stead of manufacturing.

Did u know? Why don’t they manufacture in spite of buying them from the NTTF?

The main reason of buying is cheaper than the production of an article.

Example: The management of a company finds that while the cost of making a component

part is ` 20, the same is available in the market at ` 18 with an assurance of continuous supply.

Give a suggestion whether to make or buy this part. Give also your views in case the supplier

reduces the price from ` 18 to ` 16.

The cost information is as follows:

`

Material 7.00

Direct Labour 8.00

Other variable expenses 2.00

Fixed expenses 3.00

Total ` 20.00

The first point to be found out that the contribution of the transaction. The cost of manufacturing

should be compared with the price of the product which is available in the market.

To find out the worth of the transactions, first the cost of manufacturing should be found out

`

Material 7.00

Direct Labour 8.00

Other variable expenses 2.00

Total 17.00

The cost of manufacturing a component is ` 17.00. While calculating the cost of manufacturing a

component, the fixed expenses was not considered. The fixed expenses were not considered for

computation. Why?

The costs will be incurred irrespective of the production status of the firm; for which the expenses

should not be added.

LOVELY PROFESSIONAL UNIVERSITY 107