Page 156 - DMGT202_COST_AND_MANAGEMENT_ACCOUNTING

P. 156

Unit 8: Budgetary Control

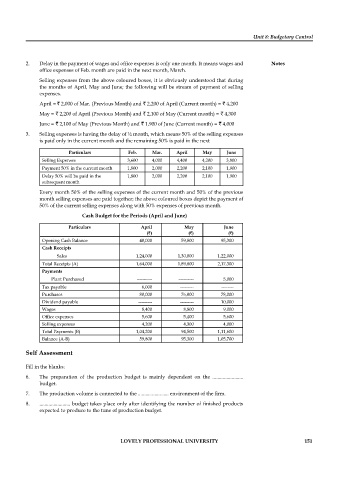

2. Delay in the payment of wages and office expenses is only one month. It means wages and Notes

office expenses of Feb. month are paid in the next month, March.

Selling expenses from the above coloured boxes, it is obviously understood that during

the months of April, May and June; the following will be stream of payment of selling

expenses.

April = ` 2,000 of Mar. (Previous Month) and ` 2,200 of April (Current month) = ` 4,200

May = ` 2,200 of April (Previous Month) and ` 2,100 of May (Current month) = ` 4,300

June = ` 2,100 of May (Previous Month) and ` 1,900 of June (Current month) = ` 4,000

3. Selling expenses is having the delay of ½ month, which means 50% of the selling expenses

is paid only in the current month and the remaining 50% is paid in the next

Particulars Feb. Mar. April May June

Selling Expenses 3,600 4,000 4,400 4,200 3,800

Payment 50% in the current month 1,800 2,000 2,200 2,100 1,900

Delay 50% will be paid in the 1,800 2,000 2,200 2,100 1,900

subsequent month

Every month 50% of the selling expenses of the current month and 50% of the previous

month selling expenses are paid together; the above coloured boxes depict the payment of

50% of the current selling expenses along with 50% expenses of previous month.

Cash Budget for the Periods (April and June)

Particulars April May June

(`) (`) (`)

Opening Cash Balance 40,000 59,800 95,300

Cash Receipts

Sales 1,24,000 1,30,000 1,22,000

Total Receipts (A) 1,64,000 1,89,800 2,17,300

Payments

Plant Purchased ---------- ---------- 5,000

Tax payable 6,000 --------- --------

Purchases 80,000 76,000 78,000

Dividend payable --------- --------- 10,000

Wages 8,400 8,800 9,000

Offi ce expenses 5,600 5,400 5,600

Selling expenses 4,200 4,300 4,000

Total Payments (B) 1,04,200 94,500 1,11,600

Balance (A-B) 59,800 95,300 1,05,700

Self Assessment

Fill in the blanks:

6. The preparation of the production budget is mainly dependent on the ........................

budget.

7. The production volume is connected to the ........................ environment of the fi rm.

8. ........................ budget takes place only after identifying the number of fi nished products

expected to produce to the tune of production budget.

LOVELY PROFESSIONAL UNIVERSITY 151