Page 158 - DMGT202_COST_AND_MANAGEMENT_ACCOUNTING

P. 158

Unit 8: Budgetary Control

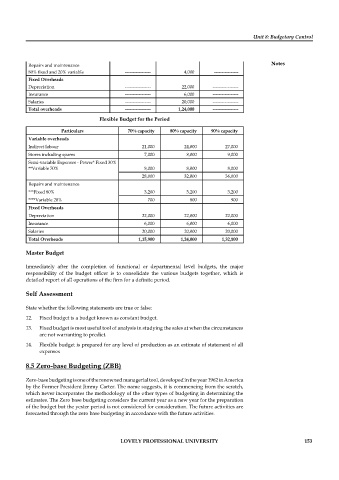

Repairs and maintenance Notes

80% fixed and 20% variable ----------------- 4,000 ----------------

Fixed Overheads

Depreciation ----------------- 22,000 -----------------

Insurance ----------------- 6,000 -----------------

Salaries ----------------- 20,000 -----------------

Total overheads ----------------- 1,24,000 -----------------

Flexible Budget for the Period

Particulars 70% capacity 80% capacity 90% capacity

Variable overheads

Indirect labour 21,000 24,000 27,000

Stores including spares 7,000 8,000 9,000

Semi-variable Expenses - Power* Fixed 30%

**Variable 70% 8,000 8,000 8,000

28,000 32,000 36,000

Repairs and maintenance

***Fixed 80% 3,200 3,200 3,200

****Variable 20% 700 800 900

Fixed Overheads

Depreciation 22,000 22,000 22,000

Insurance 6,000 6,000 6,000

Salaries 20,000 20,000 20,000

Total Overheads 1,15,900 1,24,000 1,32,100

Master Budget

Immediately after the completion of functional or departmental level budgets, the major

responsibility of the budget officer is to consolidate the various budgets together, which is

detailed report of all operations of the firm for a defi nite period.

Self Assessment

State whether the following statements are true or false:

12. Fixed budget is a budget known as constant budget.

13. Fixed budget is most useful tool of analysis in studying the sales at when the circumstances

are not warranting to predict.

14. Flexible budget is prepared for any level of production as an estimate of statement of all

expenses

8.5 Zero-base Budgeting (ZBB)

Zero-base budgeting is one of the renowned managerial tool, developed in the year 1962 in America

by the Former President Jimmy Carter. The name suggests, it is commencing from the scratch,

which never incorporates the methodology of the other types of budgeting in determining the

estimates. The Zero base budgeting considers the current year as a new year for the preparation

of the budget but the yester period is not considered for consideration. The future activities are

forecasted through the zero base budgeting in accordance with the future activities.

LOVELY PROFESSIONAL UNIVERSITY 153