Page 179 - DMGT202_COST_AND_MANAGEMENT_ACCOUNTING

P. 179

Cost and Management Accounting

Notes (ii) Intra fi rm comparison

(iii) Industrial average comparison

(iv) (i), (ii) & (iii)

8. Comparative financial statement analysis is into

(i) Comparison of income and position statements

(ii) Common size statements

(iii) Trend percentage analysis

(iv) (i), (ii) & (iii)

9. Main objectives of the financial statements analysis is

(i) To study the changes in the financial performance

(ii) To study the liquidity, solvency of the fi rm

(iii) To undergo financial planning based upon the yester fi nancial performance

(iv) (i), (ii) & (iii)

State whether the following statements are true or false:

10. Comparability between enterprises is more difficult to obtain than comparability within a

single enterprise.

11. Computation of ratios for an accounting period is a form of horizontal analysis.

12. Generally, the last concern of a financial analyst is a fi rm’s liquidity.

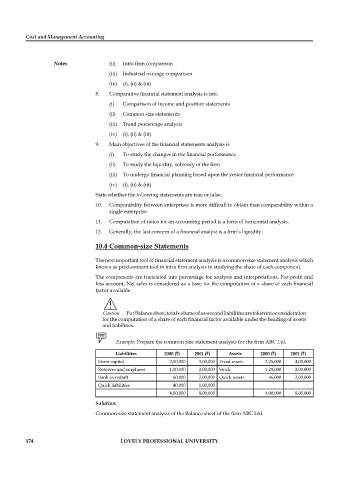

10.4 Common-size Statements

The next important tool of financial statement analysis is a common size statement analysis which

known as predominant tool in intra firm analysis in studying the share of each component.

The components are translated into percentage for analysis and interpretations. For profi t and

loss account, Net sales is considered as a base for the computation of a share of each fi nancial

factor available .

!

Caution For Balance sheet, total volume of assets and liabilities are taken into consideration

for the computation of a share of each financial factor available under the heading of assets

and liabilities.

Example: Prepare the common size statement analysis for the firm ABC Ltd.

Liabilities 2000 (`) 2001 (`) Assets 2000 (`) 2001 (`)

Share capital 2,00,000 3,00,000 Fixed assets 2,25,000 4,00,000

Reserves and surpluses 1,00,000 2,00,000 Stock 1,29,000 2,00,000

Bank overdraft 60,000 2,00,000 Quick assets 46,000 2,00,000

Quick liabilities 40,000 1,00,000

4,00,000 8,00,000 4,00,000 8,00,000

Solution:

Common size statement analysis of the Balance sheet of the firm ABC Ltd.

174 LOVELY PROFESSIONAL UNIVERSITY