Page 181 - DMGT202_COST_AND_MANAGEMENT_ACCOUNTING

P. 181

Cost and Management Accounting

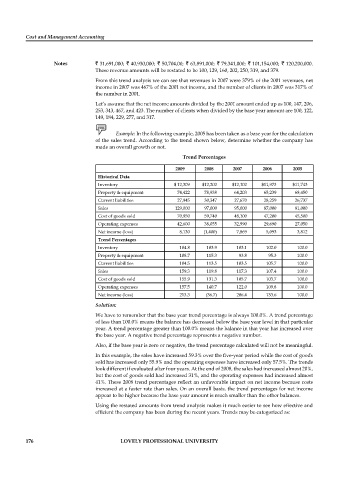

Notes ` 31,691,000; ` 40,930,000; ` 50,704,00; ` 63,891,000; ` 79,341,000; ` 101,154,000; ` 120,200,000.

These revenue amounts will be restated to be 100, 129, 160, 202, 250, 319, and 379.

From this trend analysis we can see that revenues in 2007 were 379% of the 2001 revenues, net

income in 2007 was 467% of the 2001 net income, and the number of clients in 2007 was 317% of

the number in 2001.

Let’s assume that the net income amounts divided by the 2001 amount ended up as 100, 147, 206,

253, 343, 467, and 423. The number of clients when divided by the base year amount are 100, 122,

149, 184, 229, 277, and 317.

Example: In the following example, 2005 has been taken as a base year for the calculation

of the sales trend. According to the trend shown below, determine whether the company has

made an overall growth or not.

Trend Percentages

2009 2008 2007 2006 2005

Historical Data

Inventory $ 12,309 $12,202 $12,102 $11,973 $11,743

Property & equipment 74,422 78,938 64,203 65,239 68,450

Current liabilities 27,945 30,347 27,670 28,259 26,737

Sales 129,000 97,000 95,000 87,000 81,000

Cost of goods sold 70,950 59,740 48,100 47,200 45,500

Operating expenses 42,600 38,055 32,990 29,690 27,050

Net income (loss) 8,130 (1,400) 7,869 5,093 3,812

Trend Percentages

Inventory 104.8 103.9 103.1 102.0 100.0

Property & equipment 108.7 115.3 93.8 95.3 100.0

Current liabilities 104.5 113.5 103.5 105.7 100.0

Sales 159.3 119.8 117.3 107.4 100.0

Cost of goods sold 155.9 131.3 105.7 103.7 100.0

Operating expenses 157.5 140.7 122.0 109.8 100.0

Net income (loss) 213.3 (36.7) 206.4 133.6 100.0

Solution:

We have to remember that the base year trend percentage is always 100.0%. A trend percentage

of less than 100.0% means the balance has decreased below the base year level in that particular

year. A trend percentage greater than 100.0% means the balance in that year has increased over

the base year. A negative trend percentage represents a negative number.

Also, if the base year is zero or negative, the trend percentage calculated will not be meaningful.

In this example, the sales have increased 59.3% over the five-year period while the cost of goods

sold has increased only 55.9% and the operating expenses have increased only 57.5%. The trends

look different if evaluated after four years. At the end of 2008, the sales had increased almost 20%,

but the cost of goods sold had increased 31%, and the operating expenses had increased almost

41%. These 2008 trend percentages reflect an unfavorable impact on net income because costs

increased at a faster rate than sales. On an overall basis, the trend percentages for net income

appear to be higher because the base year amount is much smaller than the other balances.

Using the restated amounts from trend analysis makes it much easier to see how effective and

efficient the company has been during the recent years. Trends may be categorized as:

176 LOVELY PROFESSIONAL UNIVERSITY