Page 180 - DMGT202_COST_AND_MANAGEMENT_ACCOUNTING

P. 180

Unit 10: Analysis of Financial Statements

Notes

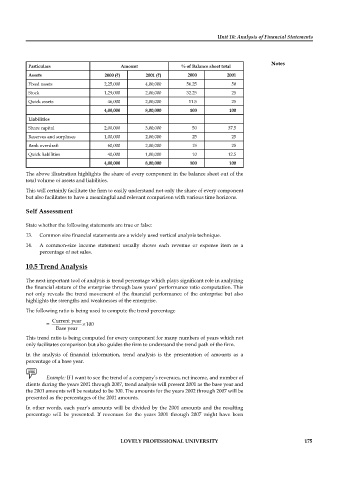

Particulars Amount % of Balance sheet total

Assets 2000 (`) 2001 (`) 2000 2001

Fixed assets 2,25,000 4,00,000 56.25 50

Stock 1,29,000 2,00,000 32.25 25

Quick assets 46,000 2,00,000 11.5 25

4,00,000 8,00,000 100 100

Liabilities

Share capital 2,00,000 3,00,000 50 37.5

Reserves and surpluses 1,00,000 2,00,000 25 25

Bank overdraft 60,000 2,00,000 15 25

Quick liabilities 40,000 1,00,000 10 12.5

4,00,000 8,00,000 100 100

The above illustration highlights the share of every component in the balance sheet out of the

total volume of assets and liabilities.

This will certainly facilitate the firm to easily understand not only the share of every component

but also facilitates to have a meaningful and relevant comparison with various time horizons.

Self Assessment

State whether the following statements are true or false:

13. Common size financial statements are a widely used vertical analysis technique.

14. A common-size income statement usually shows each revenue or expense item as a

percentage of net sales.

10.5 Trend Analysis

The next important tool of analysis is trend percentage which plays significant role in analyzing

the financial stature of the enterprise through base years’ performance ratio computation. This

not only reveals the trend movement of the financial performance of the enterprise but also

highlights the strengths and weaknesses of the enterprise.

The following ratio is being used to compute the trend percentage

Current year

= × 100

Base year

This trend ratio is being computed for every component for many numbers of years which not

only facilitates comparison but also guides the firm to understand the trend path of the fi rm.

In the analysis of financial information, trend analysis is the presentation of amounts as a

percentage of a base year.

Example: If I want to see the trend of a company’s revenues, net income, and number of

clients during the years 2001 through 2007, trend analysis will present 2001 as the base year and

the 2001 amounts will be restated to be 100. The amounts for the years 2002 through 2007 will be

presented as the percentages of the 2001 amounts.

In other words, each year’s amounts will be divided by the 2001 amounts and the resulting

percentage will be presented. If revenues for the years 2001 through 2007 might have been

LOVELY PROFESSIONAL UNIVERSITY 175