Page 22 - DMGT202_COST_AND_MANAGEMENT_ACCOUNTING

P. 22

Unit 1: Introduction to Cost Accounting

Self Assessment Notes

Fill in the blanks:

17. ...................... are not included as part of the cost of either purchased or manufactured

goods and are usually associated with the selling function of the business or its general

administration.

18. ...................... are product costs consisting of Direct Material (DM), Direct Labor (DL) and

Manufacturing Overhead.

19. The major components of ...................... are known as administrative cost of operations and

selling and distribution cost of operations.

20. A ...................... is detailed plan of operation for some specific future period. It is an estimate

prepared in advance of the period to which it applies.

1.8 Cost Accounting System

The primary goal of cost systems is to provide information for decision-making like pricing

products, managing costs, selecting market segments and distribution channels, evaluating

make-buy and outsourcing decisions, establishing transfer prices, evaluation of plant closing

and making capital investment and abandonment decisions, etc.

Designing of Costing Systems

Direct costs usually labour and material traced directly to the cost object. Overheads are allocated

to products through a two-stage process.

1. In the first stage, overhead costs are allocated to cost pools (e.g. machines, departments and

so on) using predetermined allocation criteria or cost drivers.

2. In the second stage, costs allocated to cost pools, are again allocated to cost objects (for

example, products) using cost drivers, which are chosen to capture a products consumption

of overheads costs. The two-stage procedure is given in the Figure 1.3.

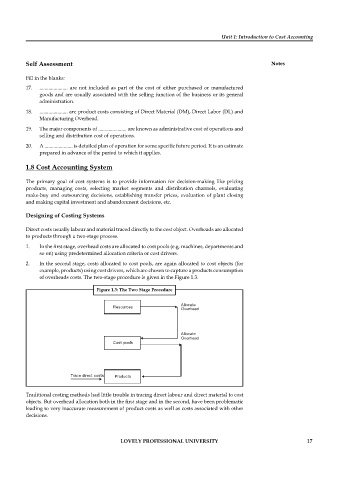

Figure 1.3: The Two Stage Procedure

Resources Allocate

Overhead

Allocate

Overhead

Cost pools

Trace direct costs Products

Traditional costing methods had little trouble in tracing direct labour and direct material to cost

objects. But overhead allocation both in the first stage and in the second, have been problematic

leading to very inaccurate measurement of product costs as well as costs associated with other

decisions.

LOVELY PROFESSIONAL UNIVERSITY 17