Page 227 - DMGT202_COST_AND_MANAGEMENT_ACCOUNTING

P. 227

Cost and Management Accounting

Notes Fund from Operations: Income generated from only operations.

Fund Lost in Operations: Loss incurred in the operations.

Increase in Working Capital: Increase in Net working capital i.e. Excess of current assets over the

current liabilities- Applications side of the fund fl ow.

Non-current Assets: Long-term assets.

Non-current Liabilities: Long-term fi nancial resources.

Statement of changes in Working Capital: Enlisting the changes taken place in between the

current assets and current liabilities of two different time horizons.

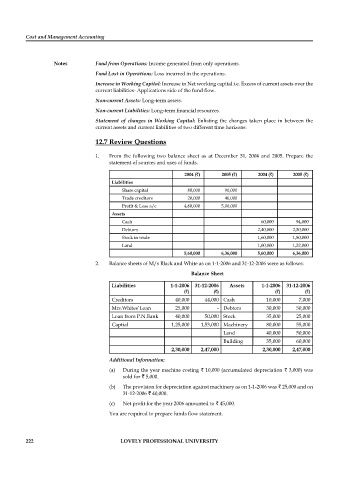

12.7 Review Questions

1. From the following two balance sheet as at December 31, 2004 and 2005. Prepare the

statement of sources and uses of funds.

2004 (`) 2005 (`) 2004 (`) 2005 (`)

Liabilities

Share capital 80,000 90,000

Trade creditors 20,000 46,000

Profit & Loss a/c 4,60,000 5,00,000

Assets

Cash 60,000 94,000

Debtors 2,40,000 2,30,000

Stock in trade 1,60,000 1,80,000

Land 1,00,000 1,32,000

5,60,000 6,36,000 5,60,000 6,36,000

2. Balance sheets of M/s Black and White as on 1-1-2006 and 31-12-2006 were as follows:

Balance Sheet

Liabilities 1-1-2006 31-12-2006 Assets 1-1-2006 31-12-2006

(`) (`) (`) (`)

Creditors 40,000 44,000 Cash 10,000 7,000

Mrs.Whites’Loan 25,000 - Debtors 30,000 50,000

Loan from P.N.Bank 40,000 50,000 Stock 35,000 25,000

Captial 1,25,000 1,53,000 Machinery 80,000 55,000

Land 40,000 50,000

Building 35,000 60,000

2,30,000 2,47,000 2,30,000 2,47,000

Additional Information:

(a) During the year machine costing ` 10,000 (accumulated depreciation ` 3,000) was

sold for ` 5,000.

(b) The provision for depreciation against machinery as on 1-1-2006 was ` 25,000 and on

31-12-2006 ` 40,000.

(c) Net profit for the year 2006 amounted to ` 45,000.

You are required to prepare funds fl ow statement.

222 LOVELY PROFESSIONAL UNIVERSITY