Page 228 - DMGT202_COST_AND_MANAGEMENT_ACCOUNTING

P. 228

Unit 12: Fund Flow Analysis

3. Discuss the various methods of determining the fund from/lost (in) operations. Notes

4. Explain the process of preparing the statement of changes in working capital.

5. Draft the pro forma of the Fund Flow Statement.

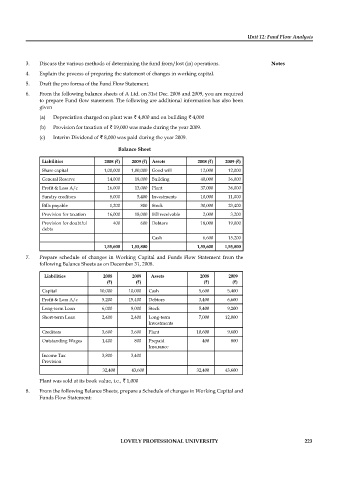

6. From the following balance sheets of A Ltd. on 31st Dec. 2008 and 2009, you are required

to prepare Fund flow statement. The following are additional information has also been

given

(a) Depreciation charged on plant was ` 4,000 and on building ` 4,000

(b) Provision for taxation of ` 19,000 was made during the year 2009.

(c) Interim Dividend of ` 8,000 was paid during the year 2009.

Balance Sheet

Liabilities 2008 (`) 2009 (`) Assets 2008 (`) 2009 (`)

Share capital 1,00,000 1,00,000 Good will 12,000 12,000

General Reserve 14,000 18,000 Building 40,000 36,000

Profit & Loss A/c 16,000 13,000 Plant 37,000 36,000

Sundry creditors 8,000 5,400 Investments 10,000 11,000

Bills payable 1,200 800 Stock 30,000 23,400

Provision for taxation 16,000 18,000 Bill receivable 2,000 3,200

Provision for doubtful 400 600 Debtors 18,000 19,000

debts

Cash 6,600 15,200

1,55,600 1,55,800 1,55,600 1,55,800

7. Prepare schedule of changes in Working Capital and Funds Flow Statement from the

following Balance Sheets as on December 31, 2008.

Liabilities 2008 2009 Assets 2008 2009

(`) (`) (`) (`)

Capital 10,000 10,000 Cash 5,600 5,400

Profit & Loss A/c 5,200 15,400 Debtors 3,400 6,600

Long-term Loan 6,000 8,000 Stock 5,400 9,200

Short-term Loan 2,400 2,400 Long-term 7,000 12,000

Investments

Creditors 3,600 3,600 Plant 10,600 9,600

Outstanding Wages 1,400 800 Prepaid 400 800

Insurance

Income Tax 3,800 3,400

Provision

32,400 43,600 32,400 43,600

Plant was sold at its book value, i.e., ` 1,000

8. From the following Balance Sheets, prepare a Schedule of changes in Working Capital and

Funds Flow Statement:

LOVELY PROFESSIONAL UNIVERSITY 223