Page 223 - DMGT202_COST_AND_MANAGEMENT_ACCOUNTING

P. 223

Cost and Management Accounting

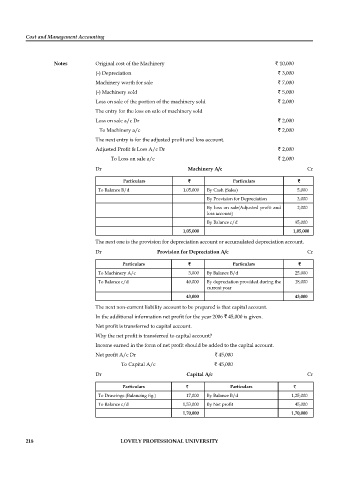

Notes Original cost of the Machinery ` 10,000

(-) Depreciation ` 3,000

Machinery worth for sale ` 7,000

(-) Machinery sold ` 5,000

Loss on sale of the portion of the machinery sold ` 2,000

The entry for the loss on sale of machinery sold

Loss on sale a/c Dr ` 2,000

To Machinery a/c ` 2,000

The next entry is for the adjusted profit and loss account.

Adjusted Profit & Loss A/c Dr ` 2,000

To Loss on sale a/c ` 2,000

Dr Machinery A/c Cr

Particulars ` ` Particulars ` `

To Balance B/d 1,05,000 By Cash (Sales) 5,000

By Provision for Depreciation 3,000

By loss on sale(Adjusted profi t and 2,000

loss account)

By Balance c/d 95,000

1,05,000 1,05,000

The next one is the provision for depreciation account or accumulated depreciation account.

Dr Provision for Depreciation A/c Cr

Particulars ` Particulars `

`

`

To Machinery A/c 3,000 By Balance B/d 25,000

To Balance c/d 40,000 By depreciation provided during the 18,000

current year

43,000 43,000

The next non-current liability account to be prepared is that capital account.

In the additional information net profit for the year 2006 ` 45,000 is given.

Net profit is transferred to capital account.

Why the net profit is transferred to capital account?

Income earned in the form of net profit should be added to the capital account.

Net profit A/c Dr ` 45,000

To Capital A/c ` 45,000

Dr Capital A/c Cr

Particulars ` Particulars `

To Drawings (Balancing fig.) 17,000 By Balance B/d 1,25,000

To Balance c/d 1,53,000 By Net profi t 45,000

1,70,000 1,70,000

218 LOVELY PROFESSIONAL UNIVERSITY